If you want to create algo-trading strategies for any market, you need data as first (historical data = Open, High, Low and Close + Volume of every past bar of the required time frame). Quality data. Would you like to know what kind of historical data you can use in StrategyQuant X or to export from Quant Data Manager? Keep reading then.

As you probably know SQX is a powerful tool for creating automatic strategies, while QDM is a program for downloading historical data only (for external use). QDM is also included in SQX as the Data Manager section.

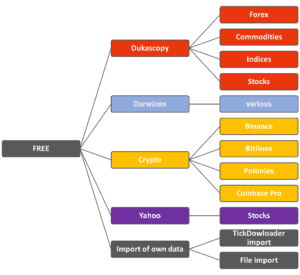

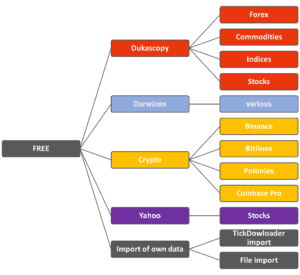

You can use data of our partners for FREE, import you own data to SQX or subscribe our high-quality data for Stocks and/or Futures.

The best way is to explore our free data on your own. If you have not done so, you can get a 14-day trial version of SQX or a free (demo) version of QDM. Afterwards, you can check the quality of data by ‘View & Analyze’ tool which you can find in ‘Tools’ tab in Data Manager.

*Paid subscription is not available in the separate Quant Data Manager program.

Dukascopy data

Dukascopy is a Swiss bank and broker. Their data are popular for Forex pairs (both major and cross pairs are available, mostly since year 2002 – 2007). You can choose either M1 or tick data.

We recommend using free Dukascopy data for Forex and Metals (XAGUSD and XAUUSD), their quality is sufficient.

You can get data also for commodities (Energy, Soft), indices (such as S&P 500, NASDAQ-100, DAX 30, etc.) and stocks (Austria, Belgium, Denmark, Germany, Finland, France, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK, and US). Historical data ranges of these instruments are not so long.

Darwinex Tick Data

The icon of an owl in Data manager offers you similar instruments as Dukascopy, however less symbols and shorter historical range (since 2017 or 2019 only).

Crypto

We want to go with the trend of the time, therefore we incorporated also pairs for Cryptocurrencies in our data supply. Under the main ‘Crypto’ selection you can find data from Binance, Bitfinex, Poloniex and Coinbase Pro exchanges. There are many different currencies and pairs – just choose your preferred time frame.

Yahoo

This item provides with stock data from Yahoo Finance. If you were interested in Stock data, we would highly recommend you considering of taking SQ Equities data.

SQ Equity and Futures data (paid subscription)

A good quality of data is a basis of success; therefore, we offer high-quality Equities and Futures data – they are available directly in StrategyQuant X. Especially Futures contracts seem to be perfect for algo-trading.

There are two trial tickers as an example of data quality (6E – EURO FX for futures AAPL – Apple Inc. for equities). You can freely download complete intraday (1 minute) and EOD data for these two symbols without data subscription.

Warning: These data are not available in the separate Quant Data Manager program!

Please visit https://strategyquant.com/data-subscription/ for current list of tickers and prices for the subscription. Do not forget – these data are included in ULTIMATE edition of SQX for lifetime! Moreover, if you subscribe SQ data, you will get a free support and updates of the software (even after the first year) for Professional license of SQX.

File import

The last option is bringing your own external data. Just click on ‘File import’ in Data Manager.

————————————————————–

Are you a newbie looking for a hint? We recommend you start either with Futures (go for SQ Futures data subscription) or Forex markets (go for Dukascopy data).

Please note that we are continually adding new data – this article comes from February 2021.

Hello Tomas Hruby,

I cannot log in to AppDemoStore to watch Interactive Data Tutorials.

May I know why?

Does it make any difference if I download both Free data and paid data into my external

hard Drive or into the PC and Save them in the Download or Document File?

I can see the Image of Visual Quant ClubServer on this platform.

May I know if you can have my previous Email request for the above format built for me?