Haftungsausschlüsse:

Kein Teil dieses Artikels stellt eine Empfehlung oder Befürwortung dar. StrategyQuant X ist broker-agnostisch und unterstützt keinen bestimmten Broker, keine Handelsplattform oder Prop-Firma. Die Performance in der Vergangenheit ist nicht unbedingt ein Indikator für zukünftige Ergebnisse.

Darwinex Zero ist der von Tradeslide Technologies Ltd. verwendete Handelsname, ein im Vereinigten Königreich unter der Nummer 14398381 eingetragenes Unternehmen. Der Inhalt dieses Artikels dient nur zu Bildungszwecken und darf nicht als Finanz- und/oder Anlageberatung verstanden werden.

Tradeslide Technologies Ltd ist ein vom Vermittler ernannter Vertreter von Tradeslide Trading Tech Ltd, der von der Financial Conduct Authority (FRN 586466) zugelassen ist und reguliert wird.

Das moderne Prop-Trading verändert die Welt des heutigen Finanzmarkthandels. Noch vor wenigen Jahren musste ein potenzieller Händler über relativ viel Kapital verfügen, damit der Handel überhaupt Sinn machte. Heute ist die Situation ganz anders, weil moderne Prop-Trading-Firmen oder andere Unternehmen auf dem Markt tätig sind. Sie bieten praktisch allen Händlern Möglichkeiten, von denen sie vor ein paar Jahren noch nicht einmal zu träumen wagten. Was früher die Domäne von Investoren und Händlern mit großen Investitionssummen war, ist heute dank des Prop-Trading oder des virtuellen Seed-Allokationsprogramms praktisch für jeden zugänglich.

In diesem Artikel möchten wir mit der Serie beginnen, wie Sie Kapital für Ihren Handel erhalten. Es gibt viele Dienste, die externes Kapital für den Handel bereitstellen können, und DarwinexZero ist einer von ihnen.

Wie funktioniert DarwinexZero?

Viele Trader wissen es nicht, aber es gibt auch virtuelle Konten. Es ist weder ein echtes Konto noch ein DEMO-Konto, es liegt irgendwo dazwischen. Sie werden ECHTE MARKTBEDINGUNGEN erleben, aber Sie werden kein Geld für den Handel verwenden. Das Konto wird mit VIRTUELLEM GELD und allen Vorteilen einer realen Ausführung, Spreads und mehr ausgestattet (dazu kommen wir später). Aber, Sie handeln und riskieren NULL Ihres eigenen Geldes.

Darwinex Zero eröffnet für Sie ein virtuelles Konto mit einem Kapital von $100.000 und 1 Million Dollar im Falle des Handels mit Futures.

Sie bieten eine Hebelwirkung von 1:30. Damit haben Sie genügend Hebelwirkung und Kapital, um verschiedene Strategien auszuführen.

Und das alles, ohne Ihr eigenes Geld aufs Spiel zu setzen. Denn Sie handeln NICHT mit Ihrem Geld. Der wichtigste Vorteil im Vergleich zu einem Demokonto ist, dass Sie hier Erfahrungen sammeln können:

Reale Marktbedingungen, einschließlich Slippage, Spreads, Swaps und Provisionen. Manchmal können die Ergebnisse auf einer DEMO zu gut erscheinen, weil sie in einem günstigeren Umfeld als der reale Markt arbeitet. Infolgedessen kann sich eine Strategie, die auf einer DEMO profitabel erscheint, in der Realität anders verhalten und möglicherweise keinen Gewinn oder einen massiven Verlust erwirtschaften. In der Vergangenheit mussten wir uns auf diese Diskrepanzen einstellen, aber ein virtuelles Konto löst dieses Problem. Das bedeutet, dass Sie jetzt mit einer ganzen Reihe von Strategien handeln können, und als Bonus werden Sie echte Ergebnisse erzielen.

Die Handelsgeschichte (Track Record) wird echt sein. In der Tat, Darwinex Zero beginnt sogar:

Bescheinigung Ihrer Erfolgsbilanz über das virtuelle Konto. Theoretisch könnten Sie sich dafür entscheiden, für immer im sicheren Raum des virtuellen Geldes zu bleiben, während Sie echte Gewinne erzielen.

Virtuelle Kapitalallokationen

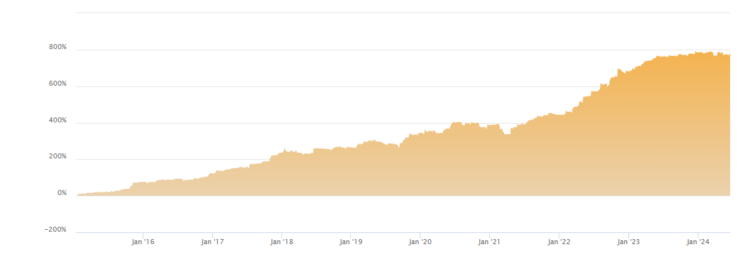

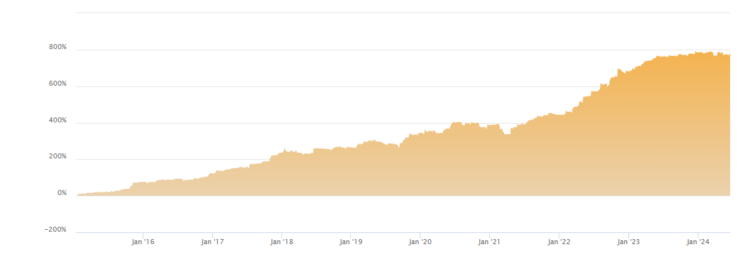

Wenn Sie gute Leistungen erbringen und mit den anfänglichen virtuellen Hunderttausend Dollar auf Ihrem Konto einen Gewinn erzielen, belohnt Darwinex Sie mit zusätzlichem virtuellem Geld, das als SEED CAPITAL oder ALLOCATIONS bezeichnet wird.

Sie werden monatlich verteilt und akkumulieren im Laufe der Zeit. Je mehr Sie sich verbessern, desto größer sind Ihre Chancen, höhere Zuweisungen zu erhalten.

Darwinex entschädigt Sie für die Erzielung von Gewinnen mit Performance Fees. Dies ist eine gängige Praxis in der Vermögensverwaltung und liegt normalerweise zwischen 10% und 20%. Darwinex zahlt Ihnen 15% des Gewinns.

Wichtig ist, dass es sich jetzt um REALES GELD handelt. Dieses System schafft eine potenzielle Quelle für passives Einkommen. Es kann eine schöne Ergänzung zum echten Handel oder zu anderen Dienstleistungen wie dem MQL-Markt werden.

Das Programm, über das Darwinex das Startkapital verteilt, heißt DarwinIA. Das virtuelle Geld wird auf der Grundlage Ihres RATINGS und Ihrer Position im Chart zugewiesen. So können Sie sich mit Händlern auf der ganzen Welt vergleichen und versuchen, in der Rangliste aufzusteigen.

Darwinien Silber

Es gibt eine garantierte Zuteilung von 30.000 € für 3 Monate, wenn Sie eine Mindestbewertung von 75 erreichen. Lassen Sie uns erkunden, was mit unserem imaginären Trader möglich ist.

Darwinex berücksichtigt drei Kriterien: den im aktuellen Monat erzielten Gewinn, den kumulierten Gewinn der letzten 5 Monate und den maximalen Drawdown des letzten Halbjahres.

Gehen wir im ersten Monat von einem Gewinn von 5% aus, mit einer kumulierten Gewinnhistorie von Null und einem maximalen Drawdown von -3%. Überraschenderweise ist das RATING 76! Da er über 75 liegt, erhält der Händler die garantierte Zuteilung von 30k. Es ist also möglich, sich bereits im ersten Monat der Nutzung des Dienstes eine Zuteilung zu sichern.

Im zweiten Monat erzielt unser Trader einen Gewinn von 10%, was zu einem kumulativen Gewinn von 5% führt, und der maximale Drawdown bleibt bei -3%. Das Rating steigt auf 95, wodurch der Händler Anspruch auf virtuelle Zuteilungen in Höhe von 165.000 € hat. Und dies ist erst der zweite Monat in Darwinex Zero.

Betrachten wir nun ein weniger erfolgreiches Szenario im dritten Monat. Wenn der Händler mit einem Verlust von -1% konfrontiert ist, bleibt das Rating immer noch ziemlich gut bei 80. Das ist der Beständigkeit der Vergangenheit zu verdanken. Er sichert sich eine weitere Allokation.

Im vierten Monat verwaltet er ein virtuelles Kapital von 225.000 € (da es sich akkumuliert). Wenn unser Händler einen Gewinn von 5% erzielt, verdient er 1.687 € pro Monat!

Was ist in DarwinIA Gold möglich?

DarwinIA GOLD eröffnet ganz andere Möglichkeiten. Die Zuteilungen sind hier bedeutender, mit dem Potenzial, bis zu 500k zu steigen, und werden für einen geraden 6-monatigen Zeitraum gewährt. Dies bietet mehr Zeit, um Gewinne zu erzielen oder Verluste auszugleichen. Wir beobachten, dass erfolgreiche Händler oft eine kumulative Zuteilung von 500.000 Euro erreichen. Sie können dies in 8 Monaten erreichen und potenziell Zugang zu Millionen an Anlegergeldern erhalten, mit denen Sie handeln können.

Betrachten wir ein Modellbeispiel, das auf unseren Beobachtungen beruht. In diesem Szenario hat ein Händler in den letzten sechs Monaten 1 Million Euro an kumulativen Zuteilungen erhalten, was natürlich eine höhere Liga ist und eine wirklich gute Strategie erfordert, aber durchaus erreichbar ist.

Die Reise muss nicht bei einfachen Allokationen aufhören. Darwinex, auch bekannt als Vermögensverwalter, bietet sogar Händlern mit virtuellem Konto die Möglichkeit, sich auf ihrer Plattform den Investoren zu präsentieren.

Jetzt kommen wir zu der Frage, warum Sie eine Erfolgsbilanz erstellen sollten.

Der Grund dafür sind die Anleger. Normalerweise kümmern sich die Händler nicht darum; der übliche Weg ist, nur mit ihren eigenen Ersparnissen zu handeln. Bei der Darwinex könnte die Reise anders verlaufen. Es ist kein unerreichbares Ziel, aber Sie können wirklich ein investierbarer, anerkannter und etablierter Trader werden.

Darwinex erstellt für jeden Benutzer einen eigenen Avatar, genannt DARWIN. Ihr Darwin ist dann Ihr größtes Kapital. Im Wesentlichen ist es Ihre Erfolgsbilanz oder, genauer gesagt, ein Index, der aus Ihren Handelssignalen besteht.

Darwinex Zero bescheinigt Ihre Geschichte, auch wenn sie von einem virtuellen Konto stammt. Sie werden als DARWIN entweder in DarwinIA unter anderen Händlern oder den Investoren präsentiert. Sie haben die Wahl, sich hier einen Ruf aufzubauen, sich selbst sichtbar zu machen, oder Ihr Unternehmen, Ihren Fonds, wenn Sie einen haben. Ein DARWIN zu haben, bedeutet automatisch Glaubwürdigkeit für die Anleger. Ohne eine Garantie des Maklers wäre es für Sie normalerweise nicht so einfach, sie zu erreichen. Die Gewinnung von Investoren erfordert Zeit, Geld und Kontakte, um nur einige zu nennen.

Andererseits können Sie, wenn Sie sich nicht offenbaren wollen, auch völlig anonym bleiben und trotzdem Investoren anziehen. Darwinex verbirgt sogar Ihre Trades in Echtzeit, so dass es keine Möglichkeit gibt, Ihren Handel zu kopieren. Die Strategie ist für immer Ihr Eigentum. Dies ist ein Vorteil, wenn Sie diesen Dienst mit dem MQL-Markt vergleichen.

Werfen wir einen Blick auf einige der DARWINs auf der Plattform

Aatu, ist ein Händler aus Finnland. Er verwaltet derzeit das Kapital von 1.600 (tausendsechshundert) Anlegern mit einem verwalteten Vermögen von insgesamt mehr als 34 Millionen Dollar. Sie können auf der Plattform nach Aatu's DARWIN suchen; sein Name ist THA. Die Anleger kommen an die Darwinex-Börse und kaufen einfach ihren DARWIN als Ticker. Sie können sich das ähnlich vorstellen wie den Kauf des S&P 500 Index.

Und er ist nicht der einzige erfolgreiche DARWIN. Es gibt noch viele andere mit einem Anlegerkapital von mehr als 500 000 USD.

Ein weiteres Beispiel ist Bentra, professioneller Pokerspieler und langjähriger StrategyQuantX Benutzer. Zum Zeitpunkt der Abfassung dieses Artikels verwaltet Bentra über 600 000 USD an Geldern von echten Anlegern aus aller Welt.

Die Realität der Vermögensverwaltung unterscheidet sich deutlich von der Eigenhandelsbranche (PROP). Bei Darwinex Zero können Sie keine 90% an Performance-Gebühren erhalten, weil man Sie auf die Welt der echten Investoren vorbereiten will, die nicht bereit sind, den Händlern einen so hohen Prozentsatz ihrer Erträge zu geben. Wir dürfen nicht vergessen, dass das Anlocken von Millionen von Euro auch bei einem geringeren Prozentsatz zu einem beträchtlichen Gewinn führen kann.

Wir beobachten, dass Händler Darwinex Zero als Instrument nutzen, um ihr Vertrauen in einer sicheren Umgebung zu stärken und sich unter realen Marktbedingungen zu trainieren. Sie nutzen es zusätzlich zum klassischen Live-Handel und zu den PROP-Firm Challenges, weil sie berichten, dass sie dort langfristige und komplexere Strategien ausführen können. Erst kürzlich hat Darwinex Zero u. a. den Handel mit Futures (sogar auf MT5!) und Cash-Aktien aufgenommen. Dies sind Beispiele für Instrumente, die von langfristigen Händlern, die ihre Erfolgsbilanz aufbauen und verbessern wollen, häufig genutzt werden.

Sie können das Abonnement über deren Website. Und natürlich bereiten wir weitere Videos und Artikel für Sie vor, in denen wir uns eingehender mit der Navigation in den Gewässern von Darwinex beschäftigen werden.

Zugelassen und reguliert durch die FCA und die CNMV

Darwinex Broker und Asset Manager sind von der Financial Conduct Authority (FCA) im Vereinigten Königreich und von der Comisión Nacional del Mercado de Valores (CNMV) in Spanien zugelassen und werden von ihnen reguliert.

Die Marke Darwinex® und die Domain www.darwinex.com sind Handelsnamen, die von Tradeslide Trading Tech Limited, einem von der Financial Conduct Authority (FCA) im Vereinigten Königreich regulierten Unternehmen mit der FRN 586466, mit der Unternehmensregisternummer 08061368 und dem eingetragenen Sitz in Acre House, 11-15 William Road, London NW1 3ER, UK, verwendet werden. und von Sapiens Markets EU Sociedad de Valores SA, einem Unternehmen, das von der Comisiónn Nacional del Mercado de Valores (CNMV) in Spanien unter der Nummer 311 reguliert wird, mit CIF A10537348 und eingetragenem Sitz in Calle de Recoletos, 19, Bajo, 28001 Madrid, Spanien.