Workflow from Test To Production

2 replies

shiny

7 years ago #116642

Hi everyone, i’m a newbie using strategy quant.

I followed the Strategy Quant ebook (adding some more robustness test) and a i built some profitable strategy.

Now before export to MT4 i want to know:

- Do I have to run an optimization step to get the optimal params or is it possibile to get them from the Walk Forward Matrix Optimization?

- When is it better to switch from Fixed size to Risk fixed % of account? (before tests or after tests?)

Thanks in advance for any answer 🙂

tomas262

7 years ago #142642

Hello,

you can run optimization in SQ to find the optimal settings for your strategy. After transfer to MT you can backtest the strategy to compare the results

We do not recommend using fixed % setting during development because the risk is set to a percentage of the account size including profits / losses created by the strategy. For example, if it earns 100 percent, we trade twice as large positions as at the beginning and the risks of individual trades are not comparable.

shiny

7 years ago #142660

Hi Tomas,

actually you wrote the same things stated in the Zanka’s report.

I think it’s my fault to not make my questions clear. Let me try again.

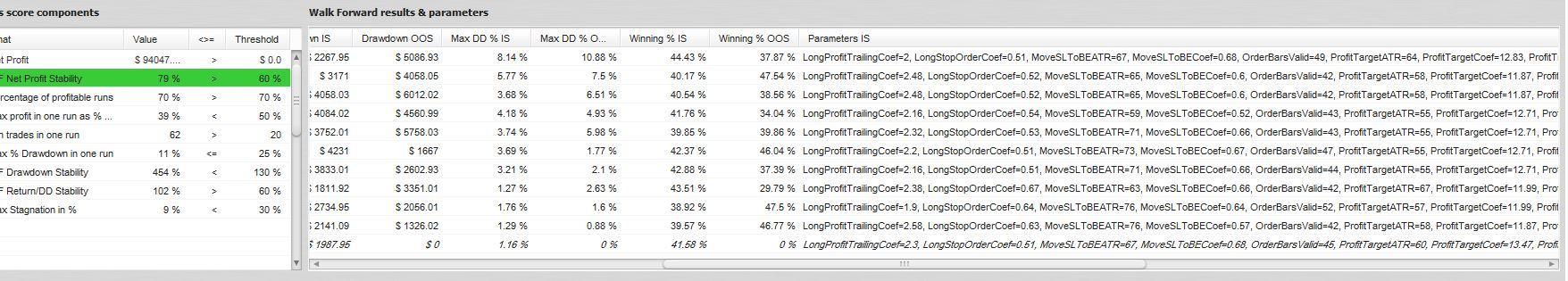

- during the Walk Forward Matrix Optimization (WFMO) the program makes a lot of WFO and put’s them in a matrix. Actually it does more and makes assumption about what will be the profit in the future in the results section. In that section you can find all the parameters for the optimal strategy as you can see in the screenshot. My question is: is there a way to use those parameters without writing them manually in the exported strategy? (i tryed to click, double click and ctrl c, but nothing works)

- In my opinion the development phase ends before starting the WFMO and because i want to run the strategy using the “Risk fixed % of account” in the real market, so using that MM during the WFMO has some kind of drawdown?

Thanks in advance

Viewing 2 replies - 1 through 2 (of 2 total)