Manual creation of a trading strategy – the old way

Manual development of a new trading strategy is a slow process.

It starts with trader using his experience and knowledge to pick up the elements of the trading strategy like technical indicators, price patterns, entry and exit order types and general strategy design.

When the prototype is finished, strategy is tested on the historical data to prove its profitability. The backtest often reveals that the strategy results are not acceptable.

So the trader has to alter it, add or change some indicators, try different ideas, different values and then test it again.

It is a long trial-and-error process with numerous iterations, revisions and testing until the strategy achieves acceptable results.

Now imagine you have a tool that does all this manual work for you, and does it 1000x faster…

The StrategyQuant way

StrategyQuant requires only a fraction of the second to automatically generate new trading strategy. It uses various combinations of technical indicators and price patterns as the entry rules, combines it with various order types (market, limit, …) and with various exit rules (fixed profit target, trailing stop, etc..).

In the end it tests the new strategy on the historical data to find out if it is profitable.

StrategyQuant can do this over and over again, generating and testing tens of the new unique strategies every second! All you have to do is pick up the best ones!

How it works – Random generation of trading strategies

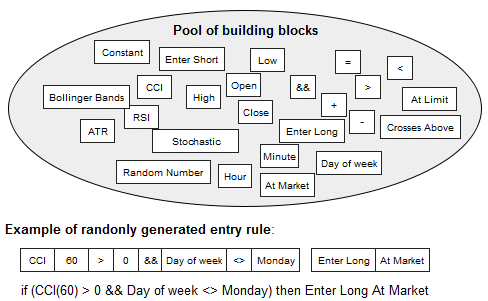

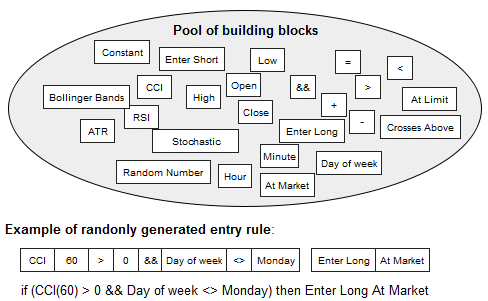

A trading strategy in the initial population is constructed using a combination of price patterns, technical indicators, order types, and other parts to form the entry and exit rules.

StrategyQuant can use all standard technical indicators and oscillators (like CCI, RSI, Stochastic, etc.), time values (like time of day, day of week) and price patterns. These building blocks are then combined using logical and equality operators (and, or, >, <, etc.) to form an entry or exit rule. In addition, it supports different entry and exit order types (market order, limit order, fixed profit target, exit after X bars, etc.).

With all the possible combinations of rules and orders, StrategyQuant is capable of generating literally trillions of different possible trading strategies.

The building process itself is completely random – builder randomly picks different building blocks from the available pool and combines them to create entry rule, order type and exit rule.

There are some validity constraints that ensure that, for example price, is not compared to time value, etc.

The result is a completely new random trading strategy.

Of course, not every randomly created strategy is profitable, but StrategyQuant can produce and test thousands of new strategies per hour, and surprisingly high percentage of strategies in this amount are profitable and sound.

Using Genetic Evolution

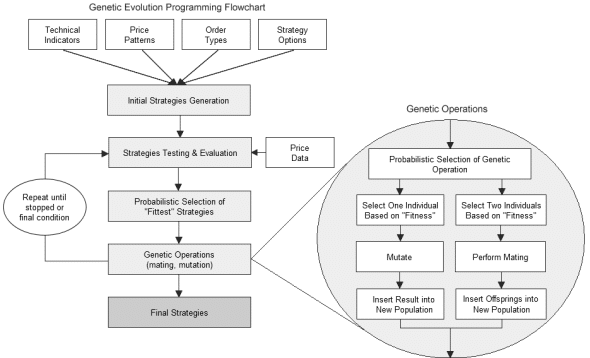

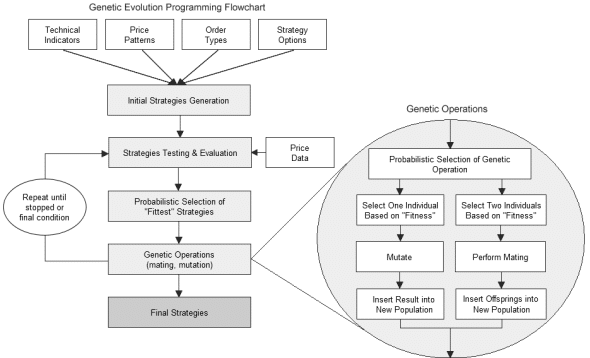

Genetic Evolution takes the process of finding a suitable trading strategies even further.

In this mode StrategyQuant first creates a number of random strategies, which are used as the initial population in the evolution.

This initial generation of strategies is then “evolved” over successive generations using genetic programming technology.

This process imitates the evolution – the algorithm chooses the fittest strategies (using selected performance criteria) in every generation, and the group of fittest candidates is then used to produce new generation of trading strategies.

As in evolution, this should result in better and better candidates, in our case in strategies that are more profitable, more stable, or generally better in the selected performance criteria.

Click on image to see a bigger picture