Is it possible to break up long-running trade into multiple trades?

19 replies

kasinath

4 years ago #261609

I’m generating EURUSD trend following strategies for D1.

Some of the strong trends ride for a very long time: 3+ years.

Instead, I’d like to try exiting and re-entering such trades after they have been running for a few months.

Is this something we achieve in SQX?

(Also,is there a technical term for this? Is this a common practice?)

Richard Brennan

4 years ago #261610

Yep K. Just introduce profit targets into your systems or time-based stops in conjunction with your trailing stops….or you might want to drop the trails.

This will increase your trade frequency and reduce your time in trade…however while you get a smoother ride in the equity curve you do sacrifice some of the ‘fat tail’ component of the outliers. The technique reduces the positive skew by introducing a touch of convergence with the profit target.

The two broad roads you could travel are:

1) Strongly divergent but volatile curves which you need to reduce through diversification of divergent return streams; or

2) Less Divergent and fewer return streams that are smoother.

Option 1 are for those that can handle drawdowns and potentially offer greater geometric returns….but Option 2 are for investors or traders that want more immediate gratification. The process of smoothing reduces the geometric returns that can be achieved.

Rich B

Richard Brennan

4 years ago #261611

These methods (eg. profit targets) are preferable to dropping down to lower timeframes as there is more noise and mean reversion as you progress down the timeframes.

Rich B

hankeys

4 years ago #261612

if your trades last long it could means many things

your SL is so huge

your strategy has low number of trades

you can set everything in the SQX – for example in ranking

without knowith your exact setting not much could be said

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

Richard Brennan

4 years ago #261616

A trend following strategy doesn’t enter at the bottom and exit at the top. It takes the meat of the trend. Positive outliers are what make TF work. By attempting to re-enter and re-exit along the course of a trend causes grief when trends are not behaving ‘exactly’ as required.

More often that not you will exit on a partial high with a profit target…..and on re-entry find that you have to fight a retracement. The process of entry and stop definition using say ATR will find you incurring many false entries along the course of a long protracted trend.

I wouldn’t be compromising the achievement that you are still riding a strong trend for the purposes of simply ‘feeling good’.

You probably are talking about some trends on EURUSD that were set up in 1985 which enjoyed a multi-year ride following that bonanza long and steady bull move. I say enjoy it. Breaking it up is going to destroy the joy of that ride in heaven. Same goes for the great short on 2014.

Rich B

kasinath

4 years ago #261635

thanks for the responses guys.

@Rich: you are spot on, re my concerns with what i would have to do and what the tradeoffs would be. the only reason why I’m considering doing this splitting up is that I am weary of a trade running for so long with a broker that I’m not familiar with. i have only held long term positions with the likes of etrade. I’ll think about it some more.

@hankeys: thanks for the feedback. I see from your signature and post history that you like strategy sharing 🙂 Great. I have attached one of the strategies I am referring to. its not one i would go live with, but I would love to hear any useful feedback you might have.

kasinath

4 years ago #261637

Actually, this other strategy (attached) is more relevant, with trades running for longer than a year.

Richard Brennan

4 years ago #261644

Kas….hope you don’t mind me commenting. I know you want feedback from others.

I had a play around with your strats. You obviously like to knock them out of the ballpark. 🙂

I undertook a road test on Pepperstone and Dukascopy on MT4 for the common date range data period of 1/1/2005 to 27/8/2020.

Looked great with not a significant material variation between the two tests (refer “Chart A”). You get the machine gun firing in some of those great trends.

I then took it for a longer road-test on Pepperstone back to 1990 (Chart B)…..and it started off great guns soaring to heaven…..and then I saw it……..the dreaded signs of Negative Skew ‘at times’ where the floating equity (green) falls below the Realised Equity (Blue).

Like all convergent ‘pressure cookers’ that warehouse risk when over-leveraged….it blew up in 2004. (Refer to “Stats” and the largest loss trade versus largest wining trade) over that period.

So I turned the risk down to 0.5% trade risk…..and it performed admirably……but watch out for those times when conditions are unfavourable with this style of ‘machine gun’ snowball strategy. (Refer Chart C)

So IMO rather than playing around with Profit Targets to squeeze extra juice out of this….I would play around with position sizing.

Test in on other data as well (other markets) to see how it performs on them. You may also need to scale the leverage down when other markets also present unfavourable conditions. After that is done….then you might have a ‘beast’ on your hands.

Cheers

Rich

Rich B

Richard Brennan

4 years ago #261647

Woohooooo ride em’ cowboy. 🙂

Kas…I put it on USDJPY D1. Nooooiice.

…but there are quite a few markets the strategy struggles on….so you might need to turn it down even further to say 0.25% trade risk or adopt a more conservative position sizing method.

Looks entirely possible as a powerful contributor to a diversified portfolio though.

Rich B

Richard Brennan

4 years ago #261659

Kas

I was twiddling my thumbs today so thought I would interrogate your strategy further and look at the multi-market potential. This is to avoid the chance of ‘selection bias’ in inferring the edge of this trend following strategy.

The ‘trailing stops and no profit target’ is essential to retain as with the large trade sample, you see how the outliers flavour the consolidated result across multi-markets. If you eliminate the outliers, you will significantly reduce the geometric returns over the long term.

Chart D shows the comparative results (0.25% trade risk) applied across 24 markets (Forex and some CFDs). Note this selection was a random one from a possible universe of markets.

There is a light ‘expectancy’ bias of the return streams in the favourable direction’….so it appears there is a definite edge….but the splay of results suggests to me that it is not a great edge….and there is quite a bit of trade inefficiency in the result (a bit of over-trading going on). It is less robust than what it could be.

When you look at the individual results (Table A) you can see this bias play out. There is a right tail to the distribution of trade results which is great….but the bias is not great. The Table is ranked by Calmar….so you nail it on USDJPY, GBPNZD, GTBPJPY etc…..but during unfavourable regimes, the inefficiency of the result does reveal itself (refer EURGBP, XPDUSD (Palladium), XNGUSD (Nat Gas) etc. This inefficiency is a concern as during unfavorable future market conditions, there is a sting in the tail from the impact of being overexposed due to your ‘machine gun’ method if the trend turns when fully loaded.

Also clearly those markets with a ‘long bias’ such as Indexes and some commodities don’t like this ‘short only strategy’….but some of the directional neutral markets luv it.

If I compile all the 24 markets together with a $200K starting balance I get Chart E. Note the highlighted yellow row for the total portfolio. Not much juice in it mate with a 1%CAGR for a 28% Max Draw from 1985 to current day.

So in general…I reckon you can do better with a more efficient and more robust diversified TF strategy.

If I cherry pick to create the best 10 markets from the universe of 24 markets…..then of course we can get a good result (Chart F)….but the Calmar is still too low for my liking. The Max Draw is >4x the CAGR which is too low.

So despite the king hit you get when you are ‘nailing the outlier’…the flip side is the sting in the tail when markets aren’t trending.

So swings and roundabouts for consideration mate.

Cheers

Rich

Rich B

hankeys

4 years ago #261663

i have many reasons why i dont like your strategy:

1) you are using not cloned data – only UTC0, will you be trading with broker with UTC0 or not? always use proper data cloned to a timezone of your broker. Daily strat with weekly filters will be different because of sunday candles and totally different daily candles, due to a time difference

2) you are using only selected TF only, not enough for DAILY strats

3) your spread for GBPJPY only 3 is low for me, i am using 6 and for market strategy always use slippage – minimum as 1 pip

4) your strategy has only 160 trades through the whole history – its not enough

5) i dont like MARKET strategies, because they will be more data sensitive, i am trading only STOP strats

6) you are not using closing friday to prevent weekly gaps – its very risky for me

7) MM is % of account i dont like, i am using only fixedsizes

8) you are using ATR SL without any restricition of MIN/MAX values in pips – do you know what are the max and min SL for 3.7 * ATR (20) for daily gbpjpy candles – by list of trades your SL is very huge – from 400-1000 pips, are you ready to trade those strats?

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

kasinath

4 years ago #261674

Fantastic feedback! Thank you gentlemen!

Rich: Thanks for taking the time to actually test this out and give such thoughtful insights. I have just started incorporating multimarket testing into my workflow. I didn’t even think to do XPDUSD and XNGUSD. Nice one.

Hankeys: Some of your feedback is actually helpful, thank you! It would be great to see some examples of strategies that you consider to be ‘good’. They don’t have to be D1 or GBPJPY. Please share here in this thread.

Richard Brennan

4 years ago #261676

Kas

Much obliged kind Sir………and thanks for sharing your strat for a chance to review it.

I really liked some of the things you had going on under the hood in that v-12 turbo charged petrol guzzler of yours:-)

Rich B

kasinath

4 years ago #261677

I really liked some of the things you had going on under the hood in that v-12 turbo charged petrol guzzler of yours

Haha. Thank you sir. The engine is showing some signs of promise. If i only it could make it around the tricky (race)tracks without the wheels falling off.

Getting there!

hankeys

4 years ago #261680

yes, daily strats will tend to have little trades, but i want to see at least 300 trades for the whole history

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

kasinath

4 years ago #261685

@hankeys: Nice, thanks for sharing. This looks like a really nice one. Good sustained pace, minimal drawdown. I like it 🙂

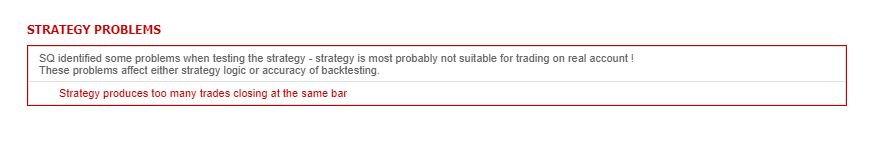

Curious: when I ran it, i got an SQX error message (attached) that i hadnt seen before. is this expected? Is it something to be concerned about? why not?