Trying to make strategies for Gold but something is wrong…

4 replies

alanhere

4 years ago #271180

Hi Team,

Hope you all are well. I’ve decided to work on strategies for other instruments and turned my head to Gold. Now, I’ve been building strategies for Forex pairs for a few years and am able to generate strategies which match that of the Metatrader backtests and also live trading.

However, with Gold.. I feel I’ve become a beginner again and for the life of me, I can’t figure it out! I assumed it was spreads so have tried adjusting these but it’s not making any difference.. the Metatrader backtests with TDS are completely different to what I’m seeing in SQ.

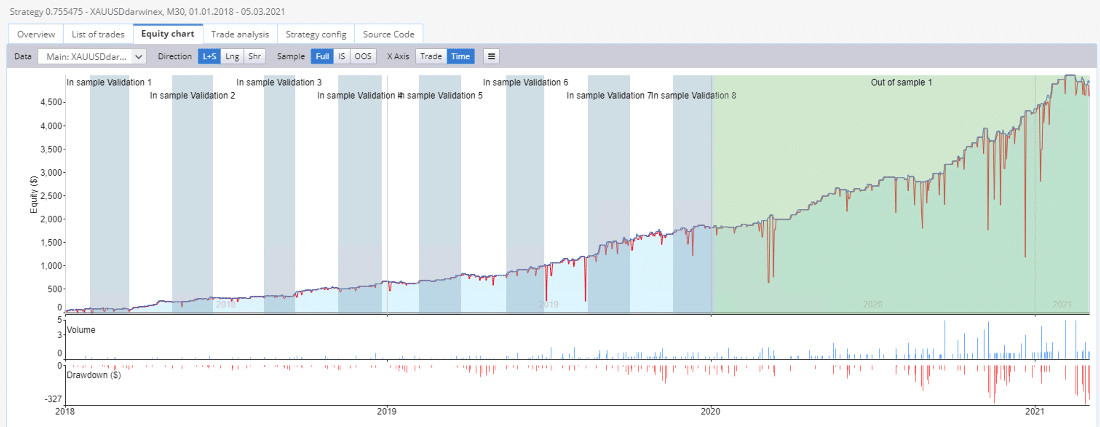

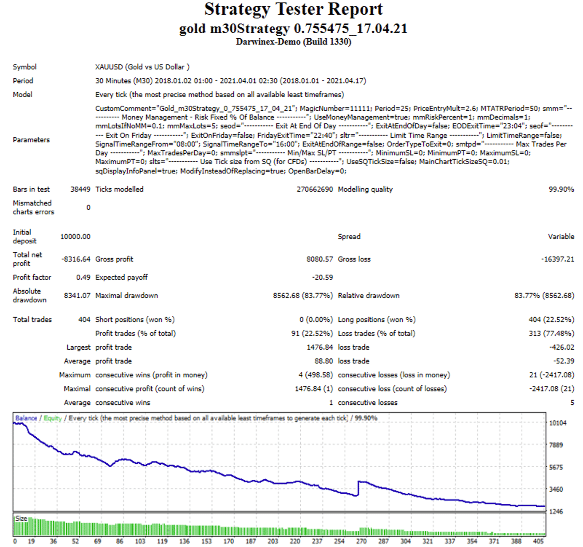

StrategyTester results (2018 with Tick Data Suite):

I include all source files – sqx, ex4, mq4

Any ideas what I’m doing wrong here? Why is there such a big difference?

hankeys

4 years ago #271300

GOLD is not an easy market, you need to know what you are doing, because it has different price values

so you need to set the data correctly, what piptick step and size you are using? how many decimal points has GOLD on your trading platform – there are brokers mostly with 2 decimal points, but some of them has 3 decimal gold – this is the first crucial thing

from pseudo code i see, that your strategy is using very low SL/TP values – like 40 or 90 pips – but gold is moving in thousands pips if you are using 0.01/0.01 setting for piptick size and step

spread 12 and no commisions? very low values for me

why you are building nonsymmetric strategy?

btw….i see that you are using darwinex data – which has UTC2 timezone, but your strategy has trades also on Sunday – this doesnt make sense – did you cloned downloaded data to EST07 timezone or not? downloaded data from darwinex are UTC0, you need to clone them. And i see it simple – dont use darwinex data, because they dont have long history, for forex+gold CFDs use dukascopy only – for GOLD from 2006 only and always clone the data to your broker timezone and everything set accordingly by your broker – because we are trading CFDs and everything could be different

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

alanhere

4 years ago #271301

Hey Hankeys

Thanks for your response… with Gold, yes a completely different ballgame.. I feel that I’ve got back to the beginning of my SQ journey! 😛

alanhere

4 years ago #271344

Does anyone know what is the spread that should be used for Gold?

My broker platform says it’s 13 but I know pips / points are different for Gold..

![]()

hankeys

4 years ago #271345

you have 2 decimal point broker – so your settings for piptick size and step 0.01

and spread will be 13, because 1 pip move will be each 0.01

but this spread is pretty low – are you using account with commission?

because for example i am using for gold spread 60 and slippage 40

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

Viewing 4 replies - 1 through 4 (of 4 total)