Workflow for Nasdaq and Other Futures Indices on TradeStation

All information including workflow settings and example strategies shared on the website is intended solely for the purpose of studying topics related to the usage of StrategyQuant software and is in no way intended as a specific investment or trading recommendation.

Neither the website operator nor the individual authors are registered brokers or investment advisers or brokers.

If specific financial products, commodities, shares, forex or options are mentioned on the website, it is always and only for the informational purposes.

The website operator is not responsible for the specific decisions of individual users.

Page contents

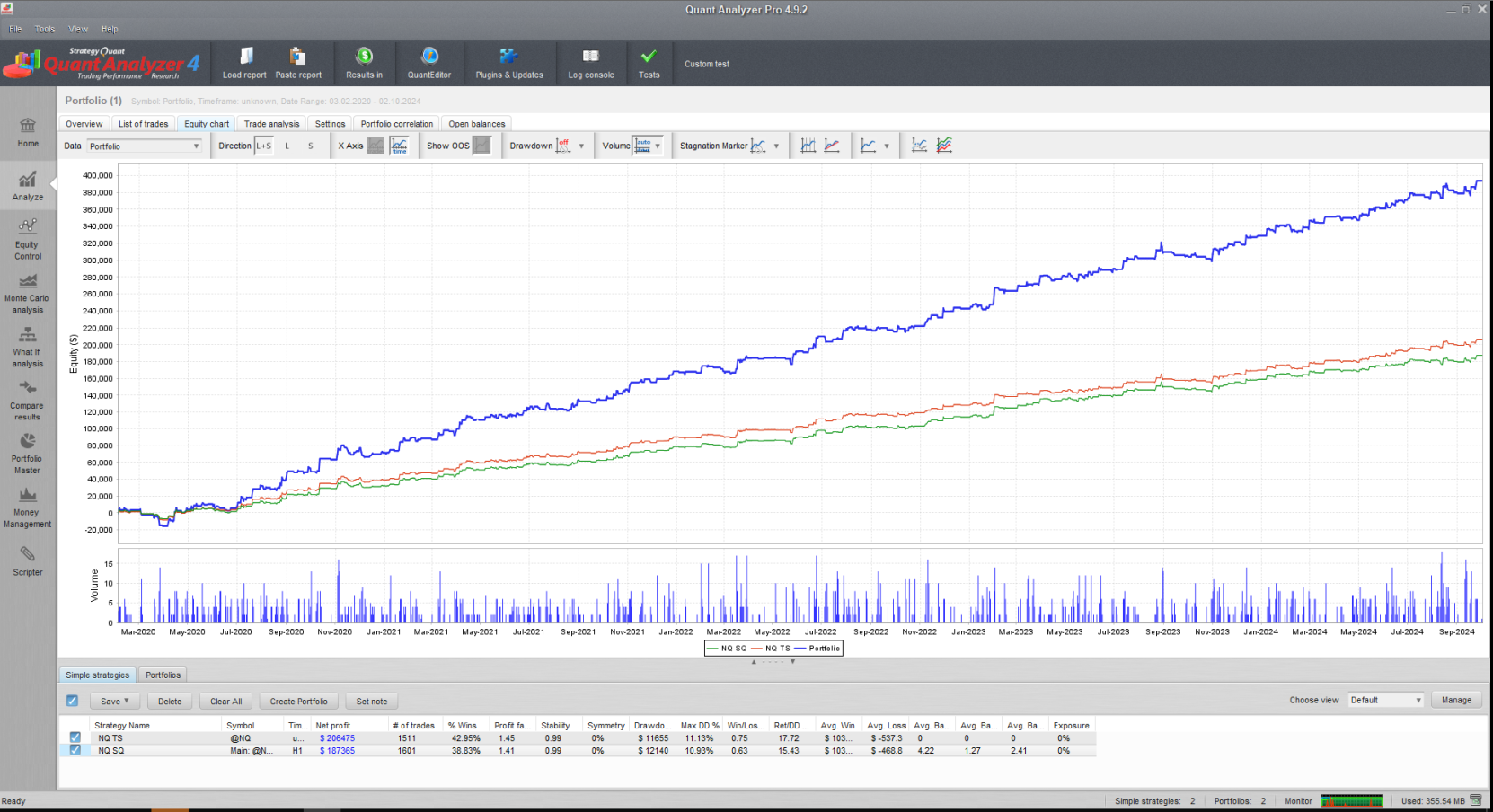

Complete workflow for swing breakout Futures Nasdaq strategies, or any other indices, based on the Tradestation engine. This workflow includes testing across different markets, slippage, two OOS (Out-Of-Sample) periods, and Monte Carlo simulations.

Please note that you will need to adjust the strategies in the data bank according to your computer’s memory and processing capabilities. Check our YouTube tutorial.

Important NOTES:

You need to import regular session to the data manager from this link.

You need SQ data subscription, or you need to import data from Tradestation using this tutorial. This workflow uses exchange timezone.

Import tickers from this config file.

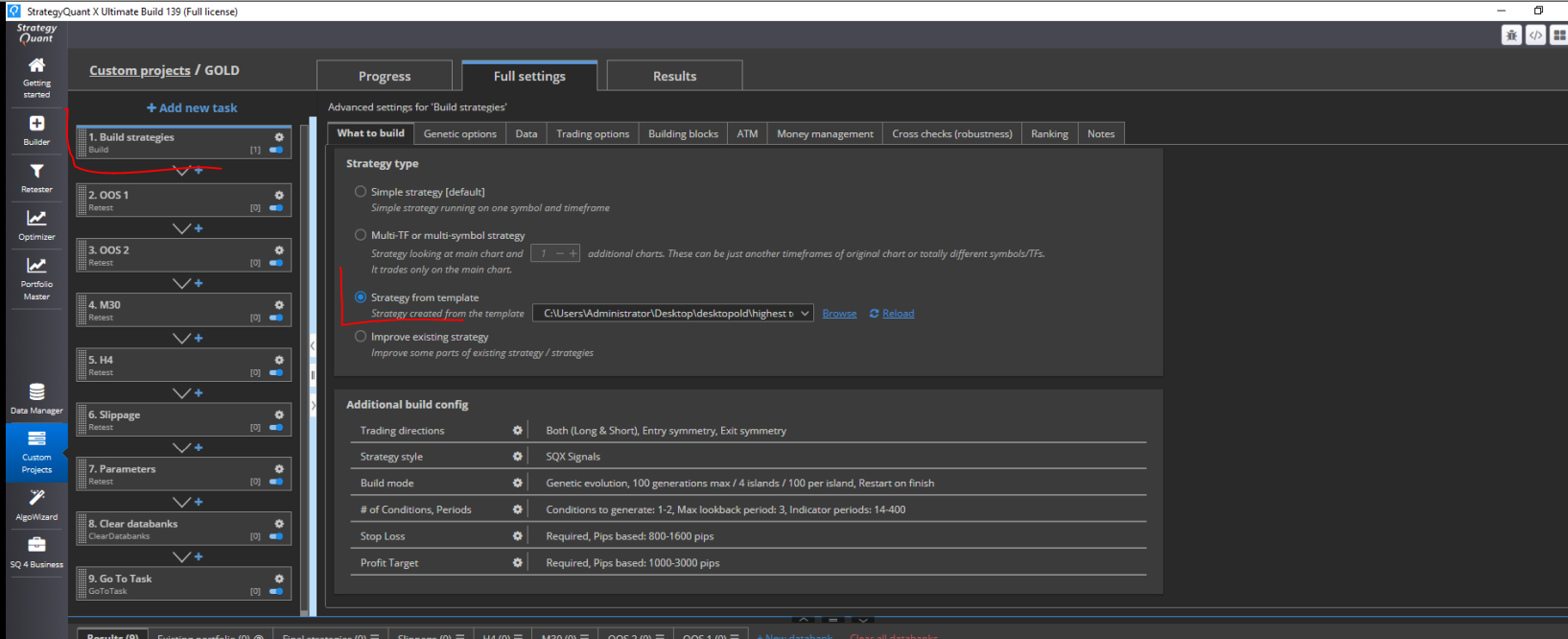

You need also to download the template here and specify the path to the template in the builder.

If your broker uses a different commission structure, you will need to adjust it in the data manager.

If any resources are missing, the Custom Project will not function properly!

How to load the template, you can see on this screen:

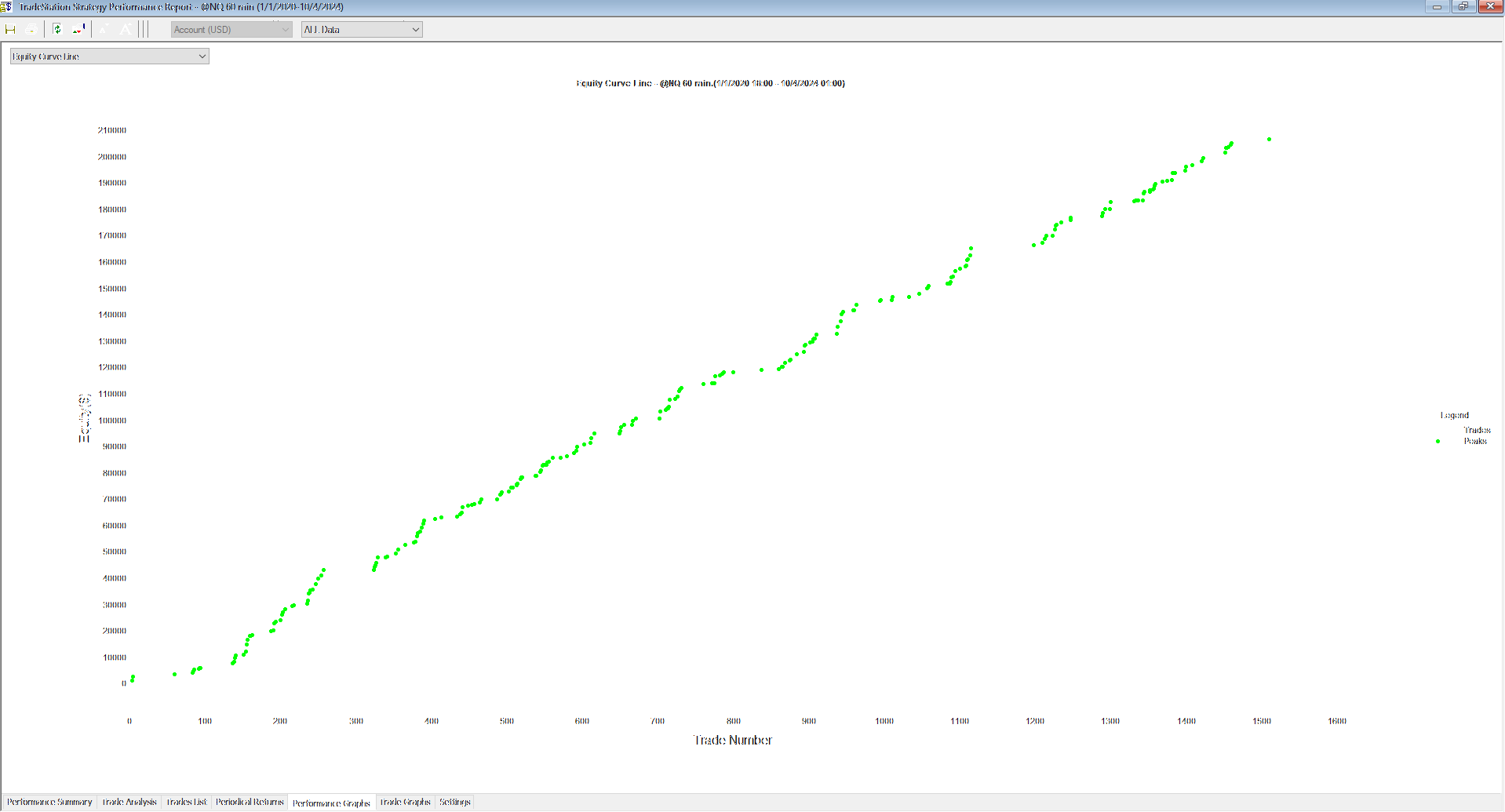

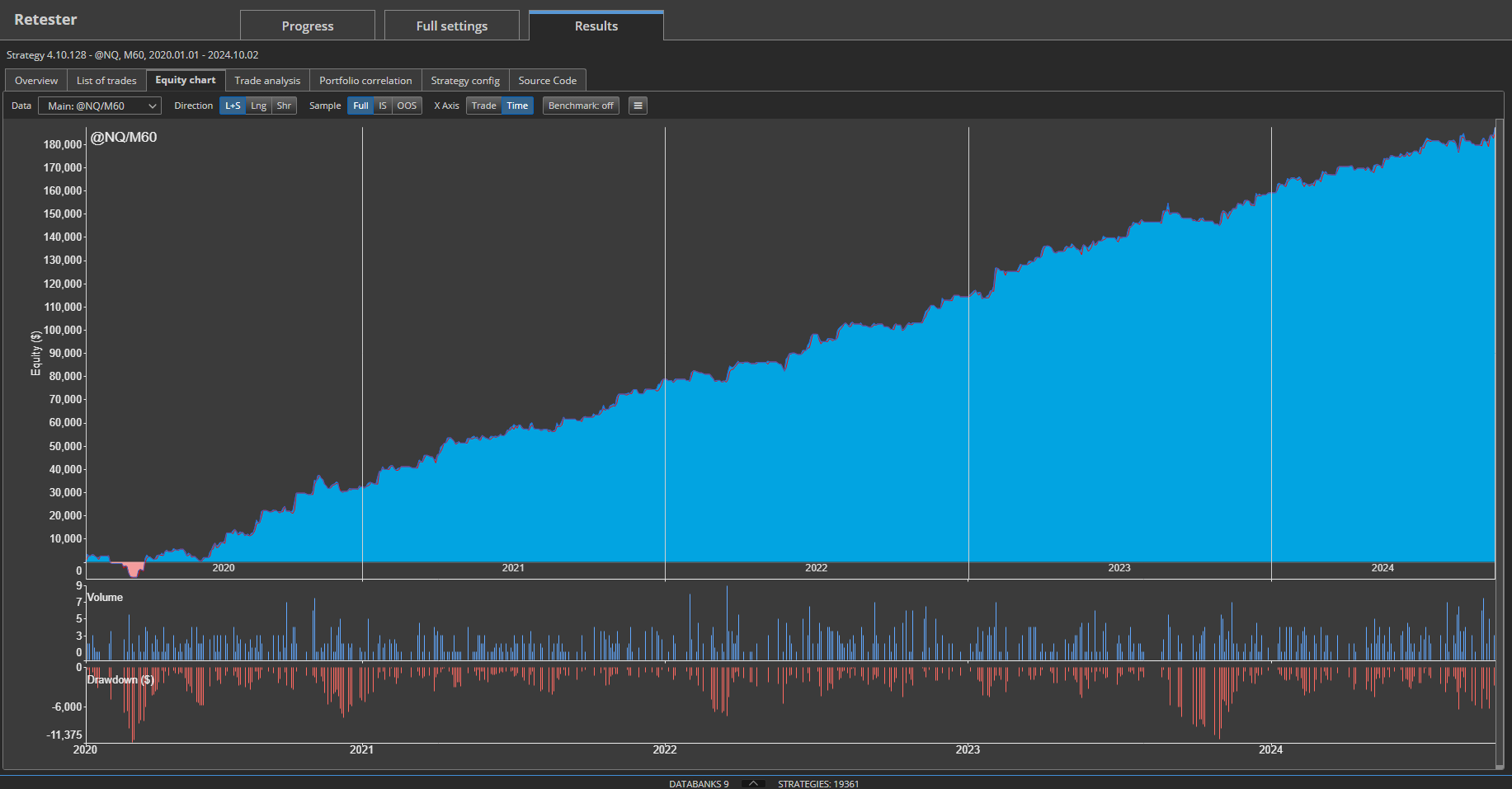

Backtest Strategy in Tradestation and results comparison

Many people struggling with the achieving the same results in TS platform as in SQX. I have decided to create this workflow as an example for achieving same results in TS platform. Here is the comparison SQ X and TS platform. In the TS it is important to set everything the same as in SQ X, otherwise your results will not match with SQ X, and it is not fault SQ X but data and backtest setting.

Backtest Strategy in Tradestation and results comparison

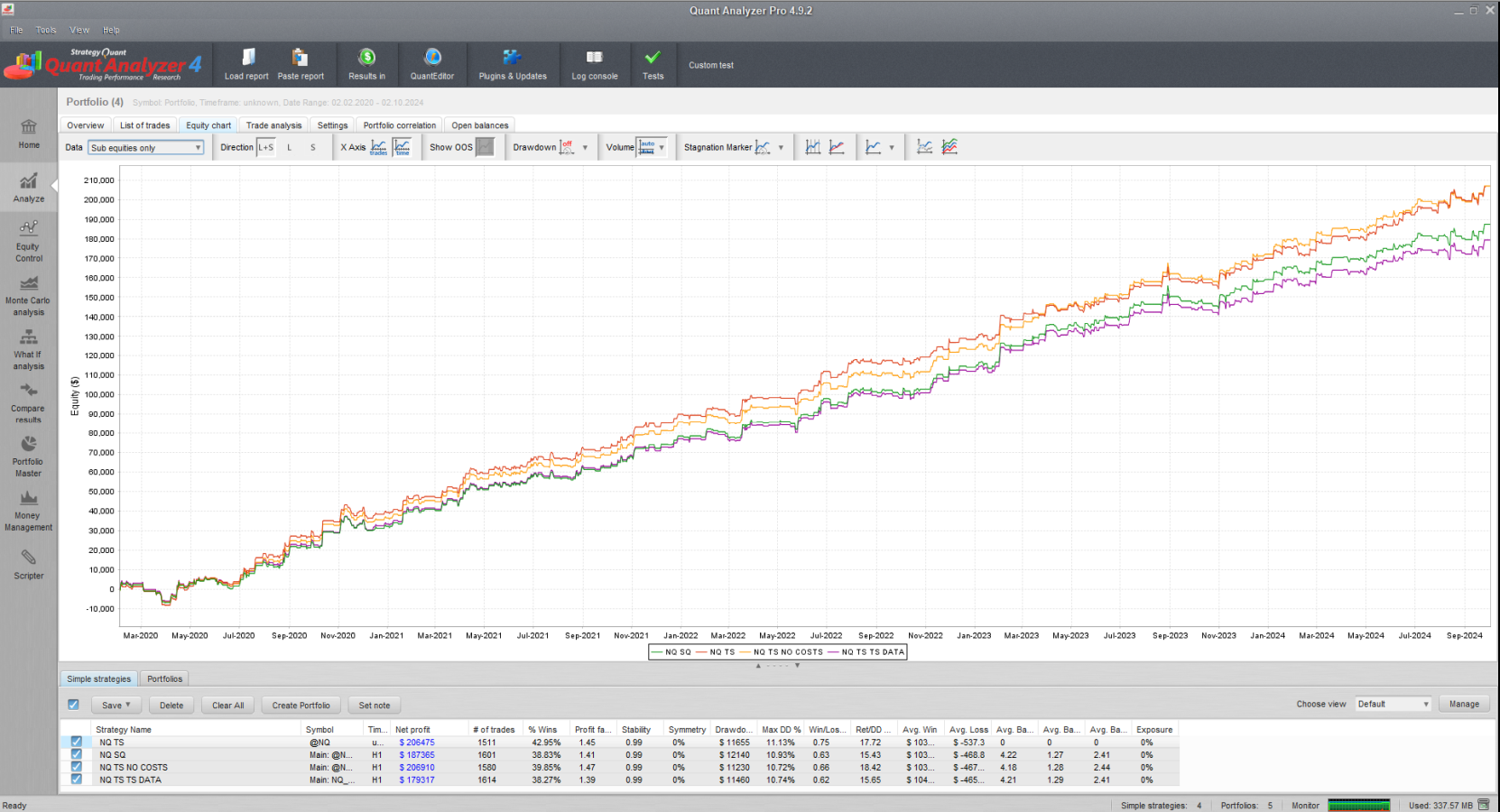

Comparison of backtests in Tradestation and StrategyQuantX, without costs, and on TradeStation data in StrategyQuantX

Conclusion

I am attaching the generated strategy as a resource for this article so that you can quickly verify your results in the Tradestation platform. If you are unable to achieve the same results, the issue likely lies in the data settings. Please note that the Tradestation backtest must have exactly the same settings for timezone and session; otherwise, the results will differ.

As you can see, the backtest in StrategyQuantX closely follows the behavior of the platform. However, there may be some small differences. It is not possible to achieve exactly the same results for each trade, but the differences should not exceed 5-10%. After developing the strategy in StrategyQuantX, you should implement and work with the strategy in your platform to gain an accurate understanding of the real trading results.

If you are new to StrategyQuant, we strongly recommend starting by building a simple strategy for one timeframe and verifying it in your platform. This will ensure that the results match with your platform, helping you avoid wasting computing power and time.