StrategyQuant YouTube Ahora en alemán - Comience su viaje hacia el trading algorítmico

Nuestro nuevo canal de YouTube en alemán ya está disponible y ha sido diseñado especialmente para usted. 👉 ¿Por qué debería echarle un vistazo?

Přejít k obsahu | Přejít k hlavnímu menu | Přejít k vyhledávání

El indicador ATR (Average True Range) Trailing Stops es una herramienta potente y dinámica que puede ayudar a los operadores a gestionar el riesgo y optimizar sus estrategias de negociación. Mediante el uso eficaz de este indicador, los operadores pueden programar mejor sus entradas y salidas, al tiempo que protegen sus beneficios y minimizan las pérdidas. En este artículo, exploraremos cómo utilizar el indicador ATR Trailing Stops y analizaremos las situaciones óptimas para su aplicación.

El indicador ATR Trailing Stops es una combinación del ATR (Average True Range) y un trailing stop. El Average True Range es una medida de volatilidad que ayuda a los operadores a comprender el rango medio de los movimientos de precios durante un periodo determinado. Combinando esta información con un trailing stop, los operadores pueden ajustar dinámicamente sus niveles de stop loss en función de la volatilidad del mercado. Esto puede ayudarles a evitar que se les detenga demasiado pronto debido a pequeñas fluctuaciones del mercado, al tiempo que protegen sus beneficios.

Esta aplicación de ATR Trailing Stops proporciona un método para identificar niveles de ruptura, determinar puntos de salida y, además, puede servir como herramienta para identificar el entorno actual del mercado.

Se puede utilizar como indicador de cuando entrar o salir de una posición. Esto se puede lograr a través de métodos de entrada ("Tipos de órdenes") como "Entrar a mercado - Invertir", "Entrar a mercado", como podemos ver en la imagen de abajo.

Se puede utilizar junto con otros indicadores a la hora de fijar el nivel de entrada a una posición utilizando el método de entrada Enter At Stop ( Tipos de órdenes ) como podemos ver en la imagen inferior.

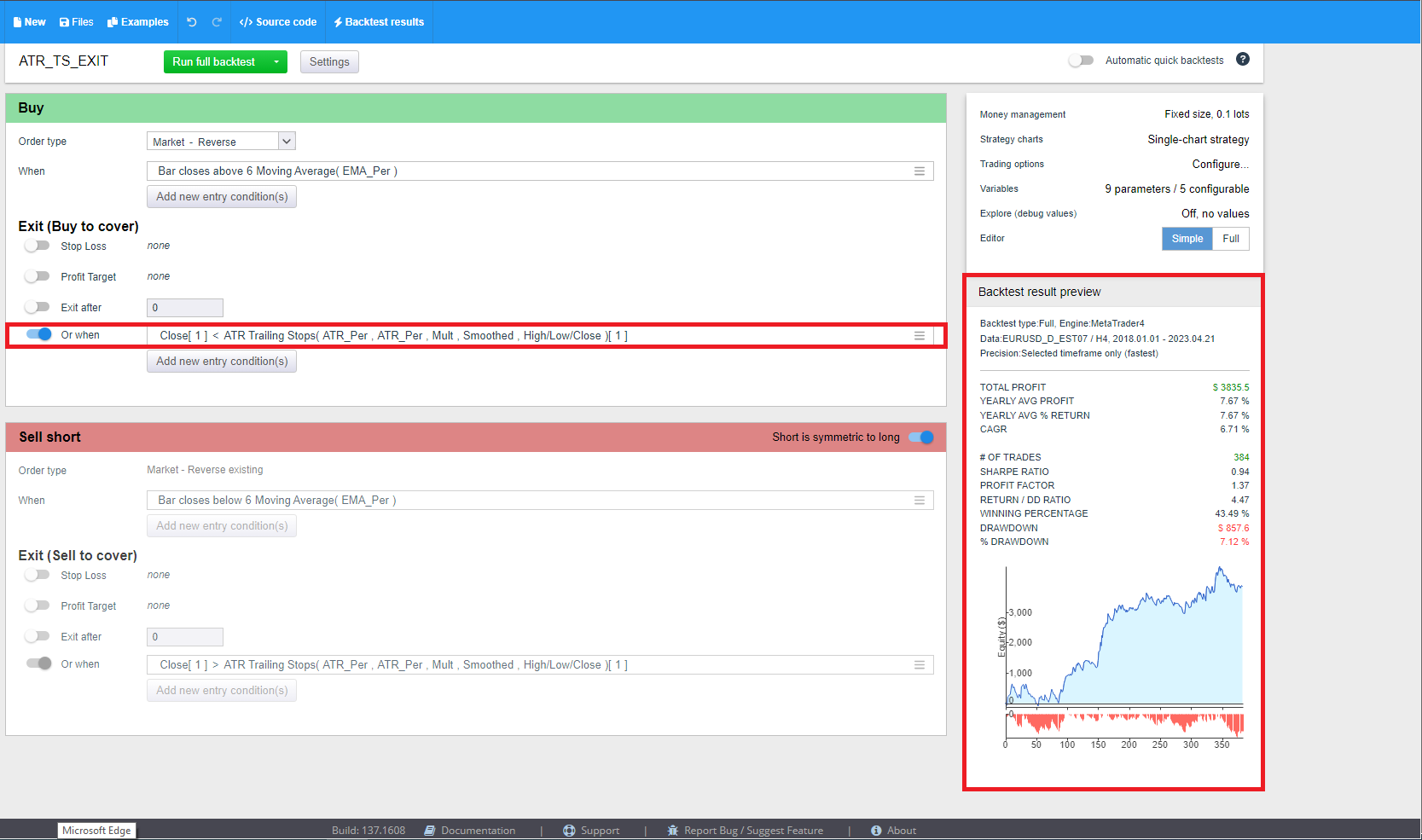

El indicador ATR Trailing Stops se puede utilizar en Algowizard como StopLoss para salir de la operación como podemos ver en la imagen inferior.

Los ATR Trailing Stops también pueden utilizarse en la parte constructora del programa StrategyQuantX, que utiliza técnicas de aprendizaje automático y programación genética para generar automáticamente nuevos sistemas automatizados.

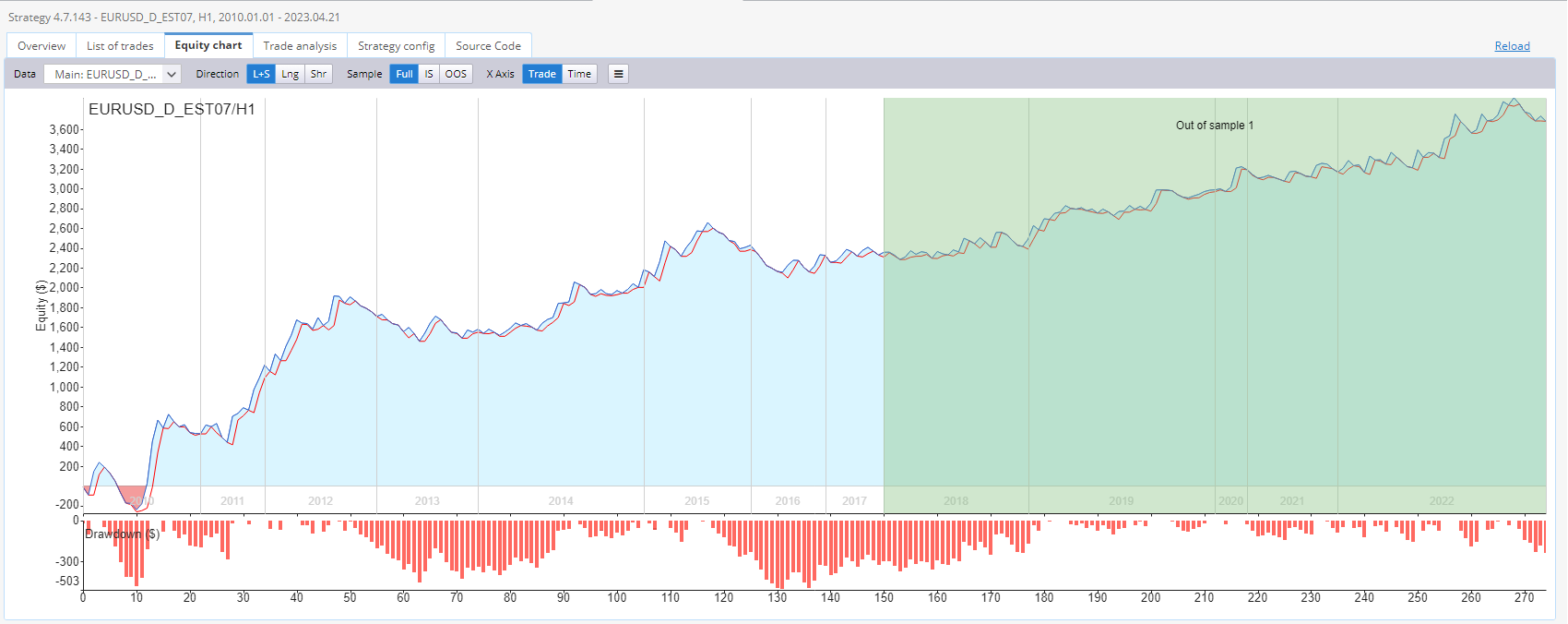

La imagen a continuación muestra la representación gráfica del rendimiento de una estrategia de negociación en particular utilizado en el EURUSD 1 Hour Timeframe. Esta estrategia está diseñada utilizando el indicador ATR Trailing Stop. La curva de equidad, que es una representación gráfica de la ganancia o pérdida generada por la estrategia durante un período específico de tiempo, se utiliza para analizar el rendimiento del sistema de comercio.

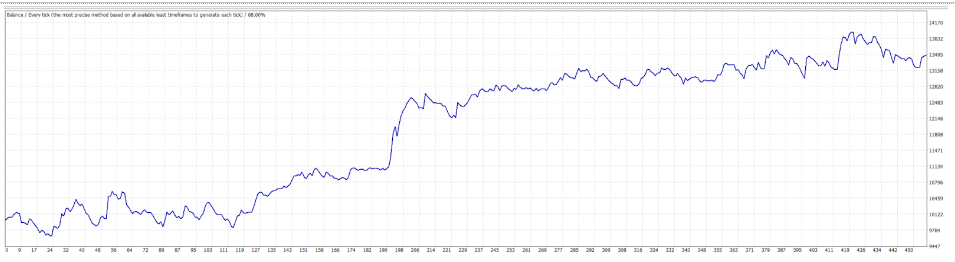

En la imagen de abajo hay otro bonito backtest de Metatrader 4 que descubrí mientras desarrollaba una estrategia para el par de divisas EURUSD en el marco temporal de 4 horas utilizando datos de Darwinex.

El indicador ATR trailing stops es una herramienta útil para los operadores que desean controlar el riesgo y mejorar sus estrategias de negociación. Al aprender a utilizar esta herramienta y reconocer cuándo puede ser útil, los operadores pueden tomar mejores decisiones y aumentar sus posibilidades de realizar operaciones rentables. Puede probar diferentes periodos ATR, periodos ATR Avg, multiplicadores o métodos de cálculo para encontrar la combinación que mejor se adapte a su estilo de negociación y a los mercados en los que opera.

Puede descargar el indicador aquí.

El indicador se aplica para: MT4/MT5/Tradestation/Multicharts

Puede preparar fácilmente sus condiciones como bloques personalizados en Algowizard Más información aquí:

En este módulo, también puede modificar los bloques personalizados: cambiar los periodos, cambiar los pasos, etc.

Cómo importar indicadores personalizados a SQX:

Nuestro nuevo canal de YouTube en alemán ya está disponible y ha sido diseñado especialmente para usted. 👉 ¿Por qué debería echarle un vistazo?

¿Quiere subir el nivel de sus operaciones? Estos indicadores se ajustan a los cambios de humor del mercado como un profesional. Por qué los indicadores adaptativos cambian las reglas del juego La mayoría de los indicadores de la vieja escuela tienen un gran defecto: ...

¿Alguna vez has deseado poder construir estrategias de negociación sin esfuerzo a través de plataformas como MetaTrader 4, MT5, TradeStation, o MultiCharts? Nuestro último vídeo desvela la nueva actualización del Asistente AI, ahora disponible para todos los motores ...

¿Se ha probado correctamente este indicador en Tradestation? Sólo trató de añadir en TS una estrategia generada en sqx que lo utiliza para las entradas y los oficios completamente no coinciden entre TS y SQX - aunque estoy usando los mismos datos en ambos.

¿Quiere decir que normalmente obtiene una coincidencia entre los resultados pero no con este indicador?

Hola, si fue probado. Envíame la estrategia no funciona a la: hudec@Kevin.com

¿En qué se diferencia del Trailing strop de Exity Types, aparte del suavizado? ¿Cuándo utilizar uno sobre el otro?