Coensio_B2_EURUSD_H1 QQE/ATR strategy

All information including workflow settings and example strategies shared on the website is intended solely for the purpose of studying topics related to the usage of StrategyQuant software and is in no way intended as a specific investment or trading recommendation.

Neither the website operator nor the individual authors are registered brokers or investment advisers or brokers.

If specific financial products, commodities, shares, forex or options are mentioned on the website, it is always and only for the informational purposes.

The website operator is not responsible for the specific decisions of individual users.

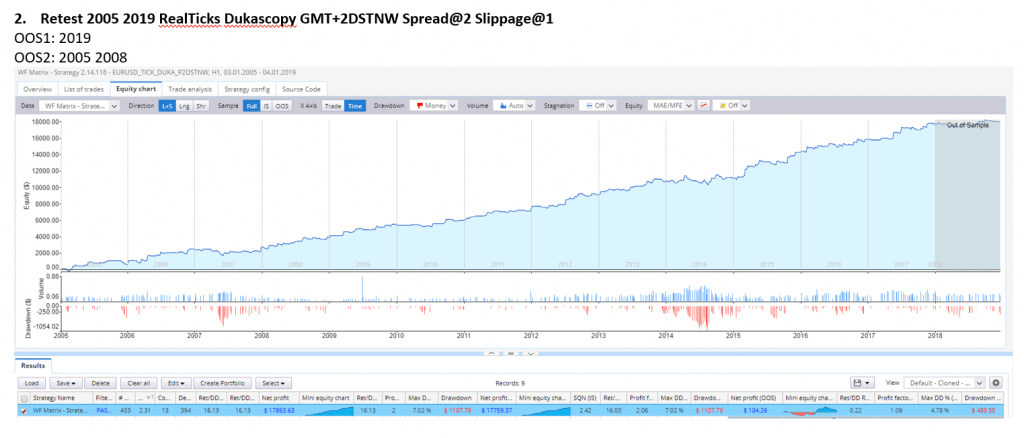

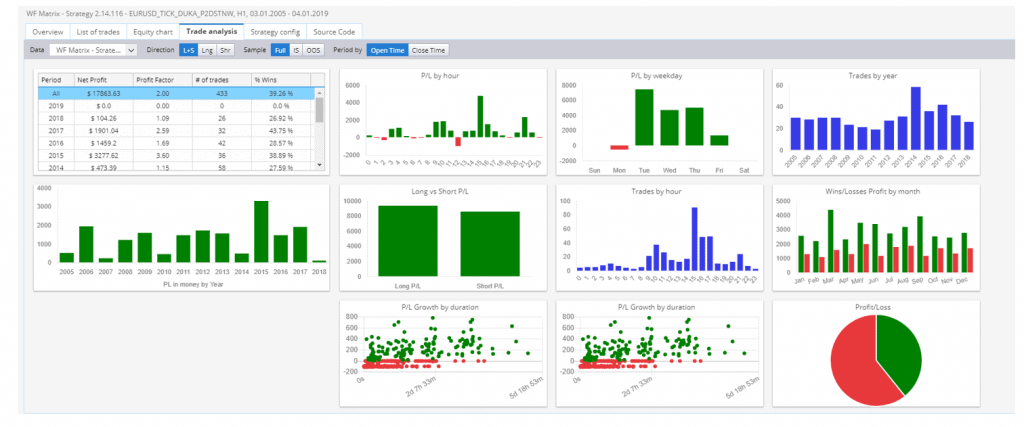

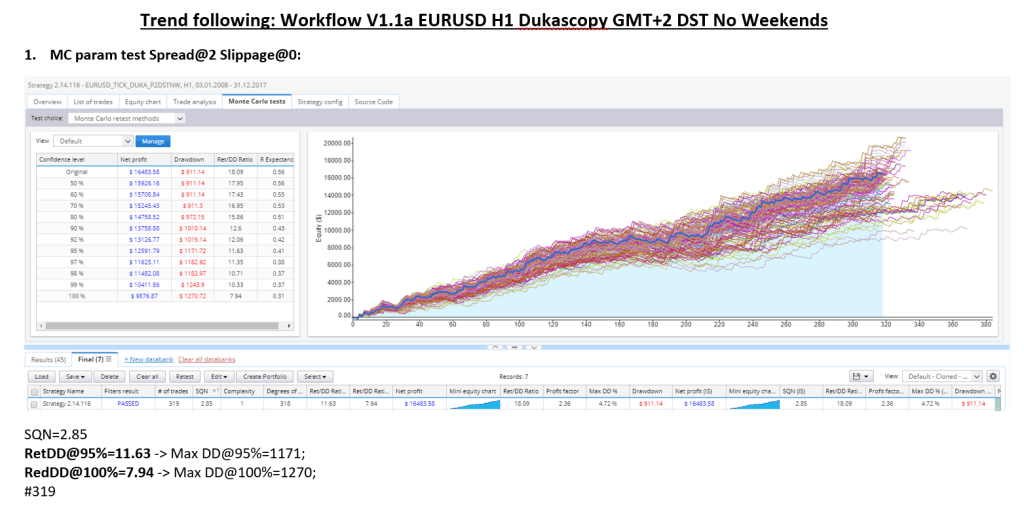

A long term breakout strategy based on QQE indicator as entry signal and ATR indicator for breakout levels calculation and control of StopLoss levels. Strategy makes only few trades per year but has a relatively high Ret/DD ratio.

Workflow used:

1 OOS test

2 Larger Slippage

3 Cross market GBPUSD

4 Higher/Lower time-frame: M30/H4

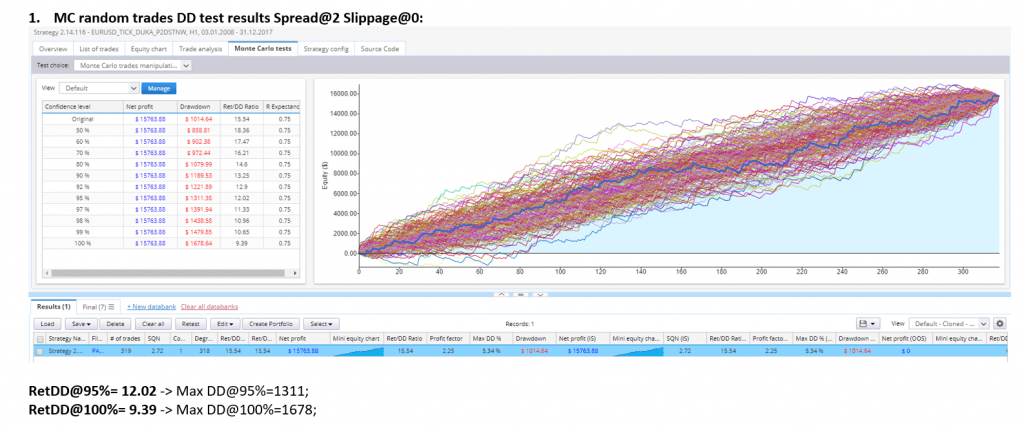

5 MC random trades

6 MC skipping trades

7 MC random parameters

8 MC random volatility ATR

9 MC random slippage

10 MC random spread

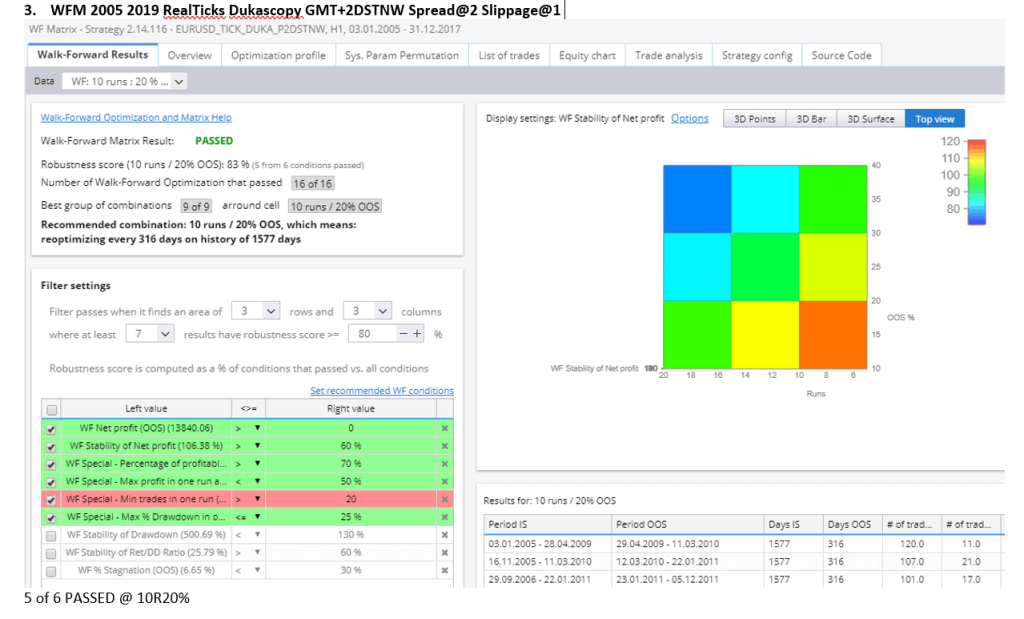

11 WFM optimization

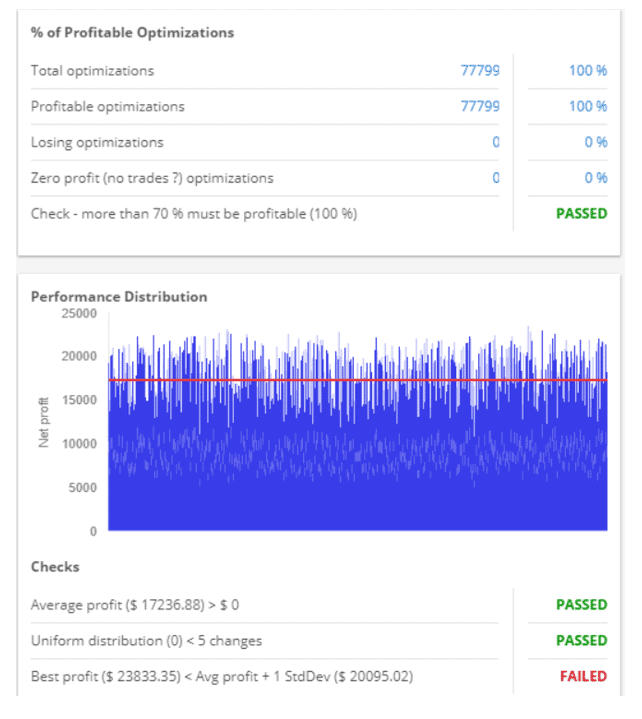

12 Optimization profile check

13 SPP check

14 Forward trading

Important note: strategy stagnates in periods with a low market volatility (like 2018 and 2019).

Also discussed on our SQ forum:

https://strategyquant.com/forum/topic/please-rate-my-new-strategy-eurusd-h1/

The strategy looks promising. Thank you for your contribution!

Thanks for sharing!

Thanks for sharing Coensio

Hi just backtested in MT4 and found very different results. Do you have any suggestion on how to reduce the gap? This can be very useful in general. Thanks.

Diego, did you use 99% accurate data when backtesting in MT4? Standard MT4 set up is not reliable for back testing.

Thanks for sharing this strategy. where can I find the QQE indicator which works with the MT4 export of this strategy ?

You can find in the StrategyQuantX \ custom_indicators \ MetaTrader4 folder

Thanks

It’s beautiful, it’s performing!!!Bravo Coensio.

Unfortunately this strategy does not working good in recent last years. (2018-2020) Too many cosecutive losses and small number of trades in that period for me

Thank you very much !! this is really interesting

Hello coensio,

can you please share the sqx-strategy file.

Thank you.

Greetings

Arvid

ITs need a QQE indicator can you post here thanks, also need help with the gird template