Release of SQX 139 Dev 1 and what’s planned for year 2024

We’d like to announce the release of the new SX 139 Dev 1 version – note that this is a development version for testing, not the final 139 version. Most …

Přejít k obsahu | Přejít k hlavnímu menu | Přejít k vyhledávání

What follows is an interview with a customer who successfully uses StrategyQuant for his trading, plus a little surprise.

The customer name is Thomas. He started using this program in 2014. He was coached by my colleague Zdenek Zanka who provides trading courses for traders in central Europe.

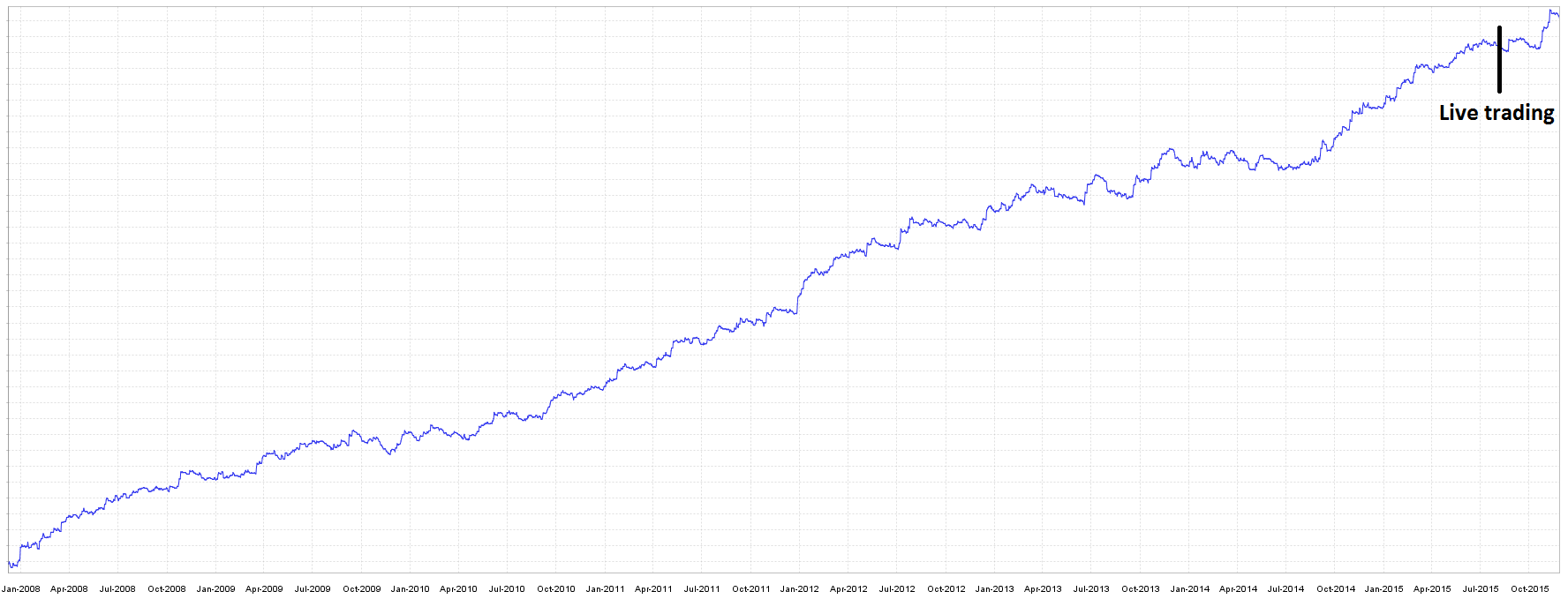

In a short time Thomas created his first portfolio of automating strategies that produced really good results on real trading account as you can see on the image shown below.

As you can see, the use of StrategyQuant and good knowledge of strategy development leads to good profits. Robust portfolio can be developed by spending two hours a day of systematic work using basic strategy development principles. Once you find the right direction of strategy development and continue using it, you can be very confident that you can become a profitable trader. Automated trading has the advantage over discretionary trading in ease of use, and elimination of time and stress (to some extent).

Thomas created 6 high quality strategies using M15 and H1 timeframe and four different currency pairs. The development is ongoing and new strategies are on their way.

What’s important in trading? Never bet on a single card!

The key to success is following simple principles.

The goal is not to find only one perfect strategy but build whole portfolio of high quality strategies. Set of diverse strategies equals to lower stress levels and better equity.

You might ask yourself, what is the best approach to develop quality strategies?

In cooperation with Mr. Zanka, we created a special Christmas offer for new StrategyQuant customers. You’ll get an e-book explaining high quality strategy development step by step for free.

And that’s not all!

Thomas was so kind and allowed us to reveal all of his successful strategies to new StrategyQuant users.

With the strategy package you are also getting a 25% discount for StrategyQuant software including full hour of consultation with our experts at strategy development department.

The interview with Thomas:

1) The first question I would like to ask you is about you – what do you do? Are you a programmer? What are your hobbies?

I work in IT, but I am not a programmer. My hobbies are hiking and travelling.

2) How did you get in trading robots? In your opinion, is it better than discretionary trading?

Trading robots always attracted me, because they do not require sitting in front of the computer (which indeed is not possible 24 hours a day), but the main reason is that it is possible to test and optimize the strategies thoroughly. I have discussed strategies and approaches with successful discretionary traders and it is never just mechanical approach. They use additional know-how and intuition in their trading. During the time I came to a conclusion that simply copying someone else’s discretionary strategies won’t work, and to gain the right feeling, which is often crucial in determining whether or not the strategy will be successful, is just not easy.

3) How did you get into trading? What were your beginnings?

I trade since about 2008. The beginnings were similar to those of most other traders. I read couple of books and I was watching educational webinars on the Internet and then tried to trade. I could not understand, why everyone’s not into it, when it’s just mouse clicking and money are coming themselves. But I found out that anyone can retrospectively analyze patterns in history and say, when to enter, exit and tell, how much you could have earned. But the real trading was different. During the time I sobered up and realized why 90 percent of people loose on Forex.

4) What helped you most to achieve excellent results via StrategyQuant?

Manual programming of strategies is a hard work and it’s time consuming. You can than optimize the strategy, find nice equity curve and put it on a real account. But in MetaTrader you can’t make many tests of robustness, so you often find out that the strategy in real market is constantly losing. That is why I was looking for a tool that can generate the strategies based on predefined parameters, but can test robustness and perform a variety of stress tests in the first place.

StrategyQuant is a program that meets these requirements and, furthermore, still continues to develop. But it is very important to set up the program correctly and to know how to use it. Mr. Zaňka helped me and taught me his know-how, for which want to thank him. I would welcome the possibility of further training and sharing the experience with other traders, who are using StrategyQuant or similar programs. Anyway, I do not dare say that I’m achieving excellent results, I am still learning and there is still something to improve.

Note: We will launch the Community website very soon and all users will have the opportunity to share strategies, to discuss, etc.

5) How much time did it take you to build a portfolio you’re trading? How big is it? How much time do you spend on trading every day?

It took me roughly about six months to create the existing portfolio. I spend on trading 1-2 hours in average daily. I spend more time on it on weekends, when I have enough time, I filter strategies and run tests and evaluate tests of robustness. Great advantage is that I do trading, when it fits me and not at the time, when the markets are opened and necessary volatility is also there – I am an employee and I don’t have time to trade at work. My current portfolio consists of six strategies – 3x EURUSD M15, 1x EURUSD H1, 1x EURJPY H1 a 1x GBPUSD H1. And I’m still working on some more strategies.

6) Are you using only standard indicators, which are part of the program, or some your own “secret†indicators?

I’m using only standard indicators. There are enough of them in the program. I do not seek the Holy Grail.

7) What in your opinion is the main reason that you are a successful trader?

I do not dare to claim that I am a successful trader, but I consider myself a trader, who is still learning and found his way to success. As a very important point I consider trading the strategies I trust, not the ones that somebody told me about on some forum or during a webinar. Doing so makes it easier for me to manage my psyche – more losing trades in a row do not stress me, because I know what to expect. And when we talk about the psyche, it is very important not to make any manual interference in the trading. I do not turn off the strategies even during the announcement of macroeconomic data.

8) Can you tell us something about your know how? How do you build the strategies?

I like strategies that are robust enough – they worked in the past, they are not sensitive to change of parameters and the currency pair. There are many (not only) novice traders, who keep telling me that it is not important how the strategies performed in the past, but how will they perform in the future. I disagree with that. We do not know the future, but we know the history. No wonder it is said that history repeats itself. That is why it is important to learn a lesson from it – evaluate the known facts well, find a statistic advantage and trade it. In addition, it is important to get ready for possible scenarios. We can’t always estimate the future, so this is the reason, why we use the portfolio of strategies to reduce this risk to a minimum.

I continue to refine and optimize the portfolio. It’s not about strategies in the portfolio being bad, I try hard to diversify the risk as much as possible. To create a valuable strategy for EURUSD pair is a matter of few hours or days, but e.g. a strategy for AUDUSD needs much more time.

9) What is your main focus when building a strategy, what factors are most important to you?

I have talked about it sooner – basic things are the robustness and diversification. There are only few strategies that pass through all the stress tests. I do not need a strategy that has linear equity, although it would be ideal. I need one that will be successful in the future.

10) Many people expect profits in tens of percent per month. What is your attitude and your expectations? How was it in the past and how has it changed?

I have never expected tens of percent per month, it seems to me unreal. I think of 30 – 100% per year as a nice result, with corresponding drawdown. The maximum drawdown always has to be kept in mind. My portfolio did 30% within the last 6 months and this fully meets my expectations.

11) Is there anything you would suggest to traders, who are trying to trade – whether manually or by using robots?

I advise to find someone who knows how to trade, who is actually trading and then learn from him. Books are good to help you with trading basics. Commonly described strategies are too general and mainly without any back tests. To find out that the “London breakout†strategy exists is very nice and you will even find out, how to trade it. But try to program the strategy and make for example 5 years back test J. StrategyQuant is for me the way how to trade robots more effectively, without paying any developer or even without learning programming myself.

12) The last question – as far as I know, trading is still not your job. Do you plan your income from robots created with SQ become your major income, eventually the only income?

Trading is my hobby and I enjoy it. To have a stable income that is created „without your own effort“ is a big challenge for me. We will see, what the future brings, as for now, I am still learning.

We’d like to announce the release of the new SX 139 Dev 1 version – note that this is a development version for testing, not the final 139 version. Most …

Dive into Algorithmic Trading Without the Coding Headache! Are you intrigued by algorithmic trading but dread the thought of coding? Today marks the beginning of our exciting series that’s about …

In this interview, we catch up with Naoufel, a seasoned trader, to explore his journey through the stormy market of 2023. Naoufel is successful trader with verfied track record who …

I have noticed you don’t monetize your site, don’t waste your traffic, you can earn extra bucks every month because you’ve got high quality content.

If you want to know how to make extra $$$, search for:

Boorfe’s tips best adsense alternative