Firstly, thank you Naoufel for giving the interview about your trading experience. In the last interview you introduced to us your verified portfolio (https://kinfo.com/portfolio/12154/performance) which has recently hit a new high, congratulations to that 🙂

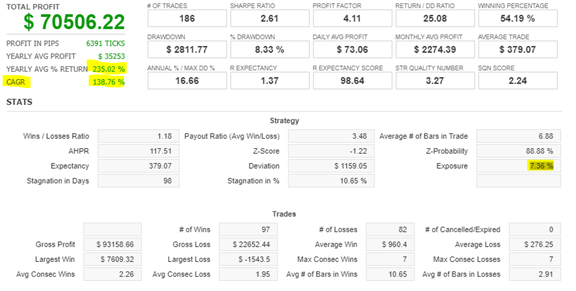

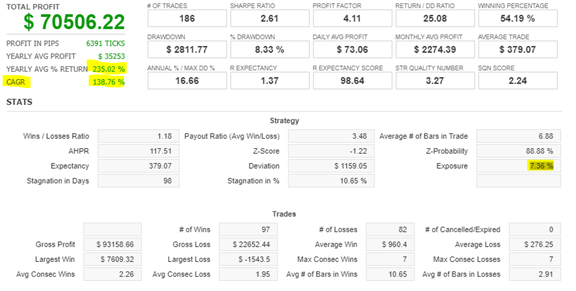

Real results of Nafouel portfolio

Could you please describe how you manage your portfolio during this turbulent period?

This is a good question. You need to follow your trade plan especially with turning off strategies that stopped performing. As an algo trader, you’ll likely realize that during a volatile period, some strategies just stopped behaving as they did in the backtest or prior to the bear market.

In my opinion, this is a good environment to filter out non robust strategies. You need to be quick to cut the strategies that don’t perform in line with your backtest. The strategies that are performing as expected are now proving that they’re robust, so we keep trading these.

Most of my strategies are long only. You could imagine that going long during a bear market is uncomfortable, and it is! However, if your algos did well during this type of environment, you should let them do the heavy lifting. During a bear market we want to see our long only strategies get stopped out fairly quickly during a move down but then be able to jump back in during bear market rallies.

If during a bear market your long only algos are just chopping around sideways from a performance perspective, then that’s a good result. If they can turn a profit by taking advantage of bear market rallies, then that’s even better.

What is your approach now compared to “peace” times?

I double down on mining. I try to mine strategies that performed on a similar market regime that we have today.

In our Mining For Gold community (https://university.tradingdominion.com/p/mining-for-gold), our members share symbols with timeframes that yield goods results with our workflows. It’s then just a matter of slightly tweaking our existing workflow in order to update the symbol and timeframe, checking that our multiple robustness tests perform as expected, and then going into either incubation or live trading of this new strategy.

I like to give this analogy regarding algo trading. It is a lot like a soccer match. You’re playing against Mr Market. You need your best players to increase your probability of winning. That’s why you need to remove bad players and only let you’re A+ players on the field.

Do you recognize any algo-trading trends/ways which work during a crisis significantly better than others?

Break out strategies work extremely well during crisis periods. Many traders have a hard time trading a system where the % win rate is around 40%. However, the main benefit is that losses are small and you have a high win-loss ratio. You can have multiples losses in a row, and you’ll need only one or two nice wins to make up for all theses losses and even make a profit in most cases. Volatility tends to be increased during bear markets, so we try to make use of strategies which can take advantage of these big bear market rallies.

Exposure is also something that we can use to our advantage. In basic terms, exposure is the percentage of time that our algo is actively involved in a trade versus just standing on the sidelines. While some traders tend to prefer strategies that have a high exposure, this can also lead to a higher likelihood that your strategy may suffer a large drawdown, especially in a bear market.

Let me illustrate this with an example of a strategy that has been mined with our custom workflow which is covered in the Mining For Gold course (https://university.tradingdominion.com/p/mining-for-gold). Here’s a strategy on a well known crypto market.

As you can see, this “long” only strategy is only exposed 7.36% of the time in the market while having a CAGR 138.76% and 235.02% annual return. In 2022, this crypto market suffered an -84% drawdown and the strategy has yielded 59% so far this year, despite being a long only strategy. Thanks to having a low exposure, it avoided most of the downside volatility.

How does your philosophy change in time as you’re gaining more experience? What are you focusing on and putting your energy into compared to times when you started running your portfolio?

If you look at what makes certain people great at what they do, such as Tiger Woods playing golf or Michael Jordan playing basketball, you learn that rather than chasing some shiny new toy they instead choose to focus on the basics, almost obsessively so.

While we should always strive to learn new things in order to become better traders, it’s extremely important to just focus on the basics. Get out there and spend time data mining with SQX. Test new symbols, new markets, new timeframes, new indicators, new entry & exit types, new ways to validate robustness, new ways of combining uncorrelated returns, etc.

Thanks to the automations available within SQX we can save a huge amount of time with the above, compared to doing it via more traditional methods.

It’s also very useful to be able to work within a community of like minded traders who can all share ideas, backtests and workflows. We’ve been fortunate to be able to work with hundreds of other traders who have gone through our Mining For Gold course and we all collaborate via forums and online chat. When the workload is split across many traders, it makes the research process far more efficient. An idea or suggestion from one member will then spark a bunch of new work within that new area and we jointly collaborate and evolve the concept from an initial idea through to a live trading algo.

Is there anything you would like to share with our community of algo-traders?

Just a reminder of the key things to focus on:

- Stick to the basics.

- Use a tool such as SQX in order to automate much of your research work.

- Find a mentor with a proven track record of live trading performance.

- Find a group of like minded traders in order to be able to collaborate, share ideas and split up the work.

hello Kornel Mazur how are you

Thanks for the nice article. Very informative.