Maximum Adverse Excursion (MAE).

5 replies

mabi

7 years ago #115400

How is MAE calculated. Must be wrong since SQ can not know this number if your bar data does not include the information but still it prints it on the list of trades. It would be better if SQ could automatically consider a trade a looser if the entering bar had a range that could have reached the stop before the target if data is not available to determine the accurate MAE.

(As a Ninjatrader user I guess the only solution is using Range bars in order to have accurate backtest results in SQ for all types of Strategies and always have a Stop loss and stay out side the bars Range with the same.)

tomas262

7 years ago #138568

When the stop-loss is set for each trade, MAE should not be ever greater then this amount. It takes lows for long positions and highs for short positions. So for trades having “Exit rule” as the exit MAE can be a smaller value.

mabi

7 years ago #138574

Okey Thanks Thomas262

There is a bar that is called Better renko that has true open and close. And another bar called Better Brick that is build on Better renko but is a combination of a renko and range bar they need tick data but in difference to time based bars you always know their range and can stay out side their range with your stop and targed by choosing a stop that is greater then the bars known range and limit the risk reward ratio to a range ST vs LP. I found during last night that i had near Market replay result with one of SQ created strategies using this setup using Ninjatrader chart data for SQ.

Well atleast until the strategy had an order rejected by Ninjatrader and then it killed it self (!?) and never issued an exit order so this morning i was down 103000 usd.( market replay 😉 )

mabi

7 years ago #138583

@ Thomas

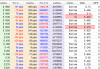

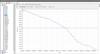

I got some tickdata for CL and SQ made some strategies on Better renko bars. It is Renkobars that has a true open and close so they are backtestable with tickdata as written above. Now I used 20 tick renko bars and put the min stop at 20 ticks since the bars are 20 ticks. Below you can se one strategy back tested in Ninjatrader and with SQ strategy. Pretty big difference and the difference is just that the MAE and MFE it is not correct . I guess it might depend on the export of data format supplied by SQ for Ninjatrader if not there is another type of bug

.

This means that Renko or any other paintbar cant be used with SQ or they can only be used with certain types of strategies i guess if you do not generate it on tick data . This will aslo give errors when papertrading or livetrading these kind of strategies where orders are being placed on the wrong side of the market since they are not removed during the generation process. Which can cause all kind of errors

tomas262

7 years ago #138609

Hello,

I will test some strategies with these alternative timeframes and let you know. It should basically work with selected timeframe precission, market or possibly stop orders and bigger stop/profit-target sizes. Unfortunately SQ cannot process tick data from source other than MetaTrader (downloaded using TickDownloader for example)

mabi

7 years ago #138645

Hi,

I tried ( Better)Brick it is like a combination of a range and a renko bar. This time I generated on Bar open only. Also stayed 2 tick outside the range ( including wicks) for min stop. Since i used this bar type i can use indicator setting to max 10 in order to catch the price action. Below strategy is using Ichomoty, Aroon and moving averages.

Way Cool !!

Viewing 5 replies - 1 through 5 (of 5 total)

MAE.png

MAE.png SQ.jpg

SQ.jpg Ninjatrader.jpg

Ninjatrader.jpg BetterBrick.jpg

BetterBrick.jpg BetterBrick SQ_NT tickdata.jpg

BetterBrick SQ_NT tickdata.jpg