Successful demo forward test.. :)

10 replies

7 years ago #115448

Hello all,

I successfully finish demo forward test of my EA portfolio. it is all from SQ..

But I modified some part of auto-generated code, and I’m happy with it.. 🙂

Actually, this is not fully automated system because I manually control this system from time to time.

I think fully automated system will eventually fail because the market is always changing.

I’ll start real forward test using this portfolio which has 80 independent strategies..

http://malim.signalstart.com/analysis/malim5-x3/3728

Thanks for this great tool !

hope you all successful trading!

BR,

CS Lim

Malim

Edinho

7 years ago #138847

Hi mucho man 😀

Do you think that you are smarter and faster than algorithm?

Believe me you are not!!My best advice is let algorithmics do their job!

Gui

7 years ago #138852

Hi Lim,

Congrats, good to see some nice and encouraging stats,

Can you explain which time frames you are trading? I see a lot of duplicated orders.

Do you have redundant systems?

And do you have a specific approach to you portfolio management (risk management- I noticed some large equity drawdown) given the redundant orders placed.

Thanks!

Think different

7 years ago #138857

Hi mucho man 😀

Do you think that you are smarter and faster than algorithm?

Believe me you are not!!My best advice is let algorithmics do their job!

Hi Edinho,

Thanks for your advice 🙂

I’m still finding better way to get more safe system. this is just one demo account of my experiments.. Don’t be seiours 🙂

I’ll keep in mind your advice.. Thanks!

Malim

7 years ago #138860

Hi Lim,

Congrats, good to see some nice and encouraging stats,

Can you explain which time frames you are trading? I see a lot of duplicated orders.

Do you have redundant systems?

And do you have a specific approach to you portfolio management (risk management- I noticed some large equity drawdown) given the redundant orders placed.

Thanks!

Hi Lucca,

I’m using M15 ~ D1 for trend following strategies, and H4 for inverse strategies.

and yes, there can be duplicated systems.

I made a portfolio search engine, and it selects the optimal combinition within the strategy pool I loaded.

actually, this work need huge computational power and it takes so long time..

I have a dual xeon E2697 + 256GB workstation, and it takes about 5 days if the candidate pool has 2000 strategies.

But if it completed, I don’t need to care about the redundancy.

Best,

CS Lim

Malim

daveng

7 years ago #138861

Hi Lucca,

I’m using M15 ~ D1 for trend following strategies, and H4 for inverse strategies.

and yes, there can be duplicated systems.

I made a portfolio search engine, and it selects the optimal combinition within the strategy pool I loaded.

actually, this work need huge computational power and it takes so long time..

I have a dual xeon E2697 + 256GB workstation, and it takes about 5 days if the candidate pool has 2000 strategies.

But if it completed, I don’t need to care about the redundancy.Best,

CS Lim

Interesting…do u mind sharing what platform are u using to create your portfolio search engine?

Coincidentally I was actually toying around this idea but have not arrive with any feasible concept yet.

Patrick

7 years ago #138862

i am very curious how it will be doing live. Will you share myfxbook/fxblue with us?

7 years ago #138875

Interesting…do u mind sharing what platform are u using to create your portfolio search engine?

Coincidentally I was actually toying around this idea but have not arrive with any feasible concept yet.

Hello daveng,

It’s just a c# program. it loads html backtest files and parse them.

there are three portfolio generation options. genetic search, random search and incremental search.

genetic search will find a optimal portfolio using genetic algorithm..

and random search just randomly mix them.

in the adaptive selecting mode, I select optimal strategy that will reduce (stagnation/drawdown…) or increase (SQN, Profit factor…) one by one.My tool automatically suggest the optimal strategy that meet my objects..

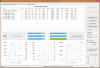

Attached file is the screenshot of MPD (I named it Malim Portfolio Designer). it’s in the incremental search mode..

after few days of searching, it can sort the result according to some performance measurements (SQN, Max Stagnation, Averaged Top 30 Stagnations, Averaged Top 30 drawdowns… etc)

I hope this will help you design the portfolio.

Best,

CS Lim

Malim

7 years ago #138876

7 years ago #138877

i am very curious how it will be doing live. Will you share myfxbook/fxblue with us?

Hello Patrick.

Yes, I’ll share the link here days later.

Malim

tnickel

7 years ago #139020

Hi karisuma,

you programm looks good. And the result of the portfolio is good too. In my view the drawdown is a little high for me.

What it the advantage about your programm against the Quant Analyser?

Have you compared the result with the QuantAnalyser?

thomas

https://monitortool.jimdofree.com/

Viewing 10 replies - 1 through 10 (of 10 total)

MDPv2_2.PNG

MDPv2_2.PNG