Cross Check: Filter: Monte Carlo as % of Original

6 replies

afhampton

6 years ago #237750

In Zdenek’s ebook/course, one of the retest method/filters he suggests using is:

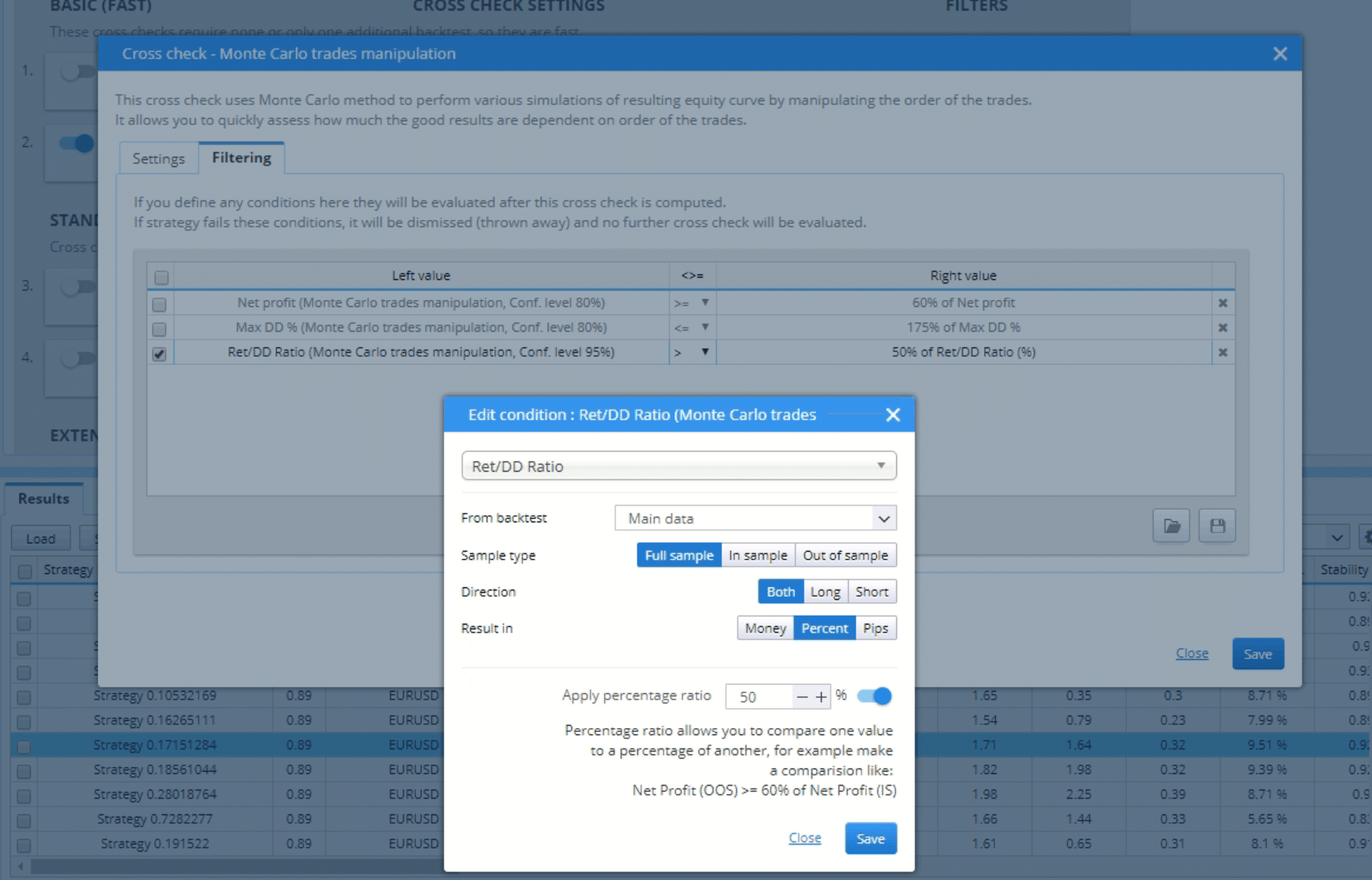

“Delete all strategies where the Ret/DD% is less than half (.50%) the original at 95% confidence”

I understand how to configure the Monte Carlo test but I can’t seem to figure out how to set the Filtering for it in SQX. The “Left” value let’s me configure “50% of Ret/DD Ratio (Monte Carlo retest methods, Conf. level 95%) but what should the “operator” be and what should the “Right value” be since this is a computed value?

For example, let’s assume the Original Ret/DD ratio is 6.8. Half of this value (50%) is 3.4. So the filter should look for a value of at least 3.4 at the 95% confidence level.

What is the proper way to configure this filter for this MC retest?

Thanks in advance.

Ilya

6 years ago #237759

Hi,

Attached is my way of doing it, including settings of the right-side value. (This is for trades manipulation, but it’s exactly the same for retest methods)

Small opinion though, if I may: I noticed I ended up losing many high quality strategies that are doing well on my incubation demo accounts, when I apply this rule strictly as shown. In my point of view, looking from a robustness perspective, if a strategy has a very high original ret/dd, and survived vigorous tests such as the strategy parameters manipulation, do you real care that it’s let’s say 5 ret/dd ratio at 95%, for a 13 ret/dd (original) strategy?

Small opinion though, if I may: I noticed I ended up losing many high quality strategies that are doing well on my incubation demo accounts, when I apply this rule strictly as shown. In my point of view, looking from a robustness perspective, if a strategy has a very high original ret/dd, and survived vigorous tests such as the strategy parameters manipulation, do you real care that it’s let’s say 5 ret/dd ratio at 95%, for a 13 ret/dd (original) strategy?

The SQ X robustness & Filtering abilities are brilliant, but some filtering should still be done manually, in my eyes.

Ilya

afhampton

6 years ago #237763

Thank you Ilya. Very good point regarding the application of this rule. I’ll certainly give it some consideration. I appreciate the help.

Aaron

Ash24FX

6 years ago #237764

The step by step guide to set up the filter can be found here, starting at slide 48. Looks identical to the settings Ilya posted, but walks you through it

http://www.appdemostore.com/demo?id=4814939983183872

afhampton

6 years ago #237774

Thank you Ash24FX. I’ll take a look at it.

hankeys

6 years ago #237782

the 50% filtering could be translated also as follows – expect in the future minimum 50% performance as what you see in the backtest

if i have strategy with RDD 10, MC RDD 6 – i have 60%, so i can live with the assumption of 50% in the future

but if i filter RDD 20, MC RDD 8 – i have only 40%, but in the meaning of the value of MC RDD i get better strategy, by i move the expectation of the strategy in the future. So its hard to say what will be the expectation.

You want to be a profitable algotrader? We started using StrateQuant software in early 2014. For now we have a very big knowhow for building EAs for every possible types of markets. We share this knowhow, apps, tools and also all final strategies with real traders. If you want to join us, fill in the FORM.

bentra

6 years ago #237784

do you real care that it’s let’s say 5 ret/dd ratio at 95%, for a 13 ret/dd (original) strategy? The SQ X robustness & Filtering abilities are brilliant, but some filtering should still be done manually, in my eyes. Ilya

I agree!

the 50% filtering could be translated also as follows – expect in the future minimum 50% performance as what you see in the backtest if i have strategy with RDD 10, MC RDD 6 – i have 60%, so i can live with the assumption of 50% in the future but if i filter RDD 20, MC RDD 8 – i have only 40%, but in the meaning of the value of MC RDD i get better strategy, by i move the expectation of the strategy in the future. So its hard to say what will be the expectation.

I love the 50% for robustness and expectation testing and filtering too! The 95%-99% I use it only for lot size calculations and other worse case calculations. For instance, with excellent everything else but an ugly 95-99%, no need to turf it, just use smaller risk size.

Viewing 6 replies - 1 through 6 (of 6 total)