Seasonal effects in forex market

2 replies

mikeyc

8 years ago #115000

Hi everyone,

Another angle I’m looking at, to tip the probabilities in our favour are seasonal effects.

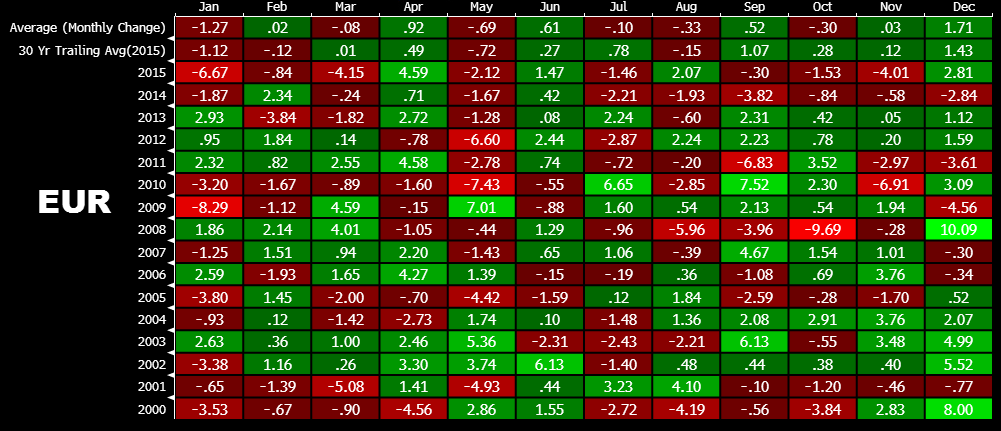

Here is a table showing monthly price changes, averaged over a long period:

So, sell the EUR in Jan for sure (only go short), buy in April and again in December.

Here’s one for oil:

The other option is to use the seasonal effect in the money management, i.e. use bigger lot sizes on longs for green months, and bigger lot sizes for shorts in red months.

What is needed is a statistical analysis of significance and a measure of association (probably using correlation).

In the meantime I might take an existing MQ4 strategy generated by SQ and play with using the average change to alter the lot sizes for long and short accordingly.

Cheers,

Mike

PS, feel free to give an opinion on this “edge”

tomas262

8 years ago #136380

For more on seasonality you can look at

there are many others

Threshold

8 years ago #136409

+1 MRCI, been around a long time.

I don’t use seasonals for currencies but this is mainly because my trades last from 1-8 days on average.

Viewing 2 replies - 1 through 2 (of 2 total)