Strategyquant Success

31 replies

alanhere

4 years ago #268203

HI Everyone,

Someone emailed me today asking me about how I have found StrategyQuant after seeing that I’ve been a user for over 2 years and this prompted me to write about my journey using it and where it’s led me to this date. I’ve very much enjoyed using the product and initially after clicking a few buttons and getting some decent looking backtests, I thought.. “this is it! I’ve now got algos which will just make me an immense amount of money!” However, if only it was this easy.. indeed like a lot of beginners, I put these into live operation to find that the results were nothing like backtests… even getting the backtests to look as good in Metatrader with tick data didn’t seem to work.

However, I stuck at it and you have to remember that StrategyQuant is just a tool to help you pretty much like how a calculator can help you do complex sums quickly and accurate BUT… it depends on you pressing the right buttons and feeding in the correct information. StrategyQuant is exactly the same.. you need to make as the operator you know what you’re doing.. take time to learn about the software and also take the time to learn about how algo trading works in the real world. Most systems fail because of curve fitting… then every broker differentiates in terms of their prices, spreads, timezones.. even their data feeds. What may seem like small differences in their data feeds can make a world of difference and depending on the entry / exit criteria and the indicators you’re using can all yield very different results.

To cut a very long story short, StrategyQuant is an amazing product but take time and dedication to learn.. and experiment. I’ve put in at least an hour a day over the past two years experimenting, testing and refining. There is no perfect solution and no perfect algo… markets will change but the key is to build a portfolio of algorithms and to constantly refine the portfolio.. monitoring them and removing when they start to fail and adding ones which seem to be working into your live working portfolio.

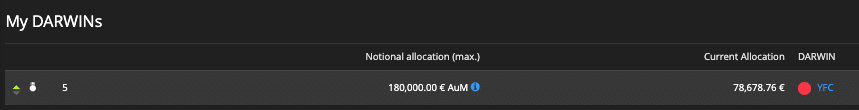

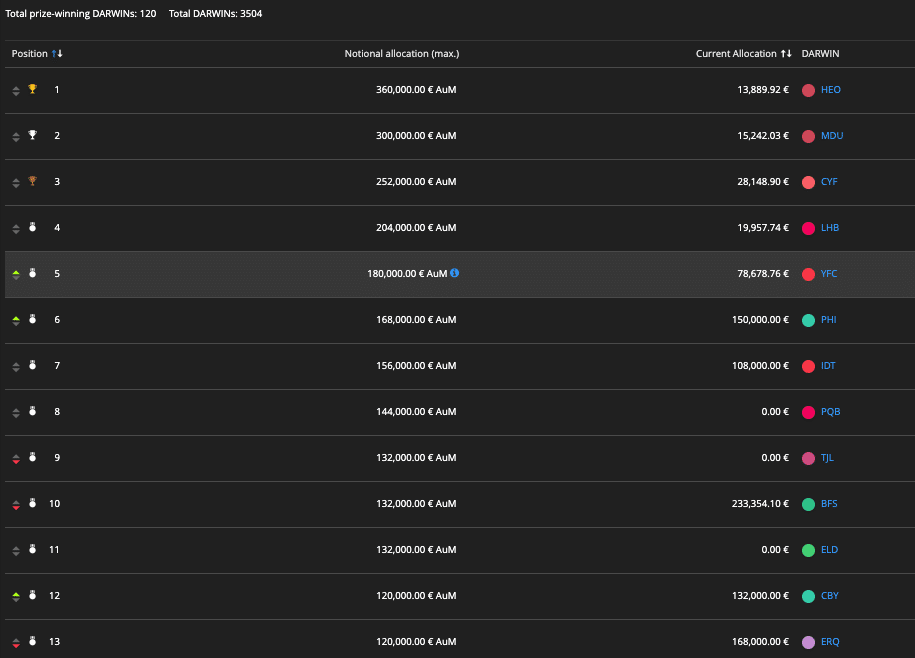

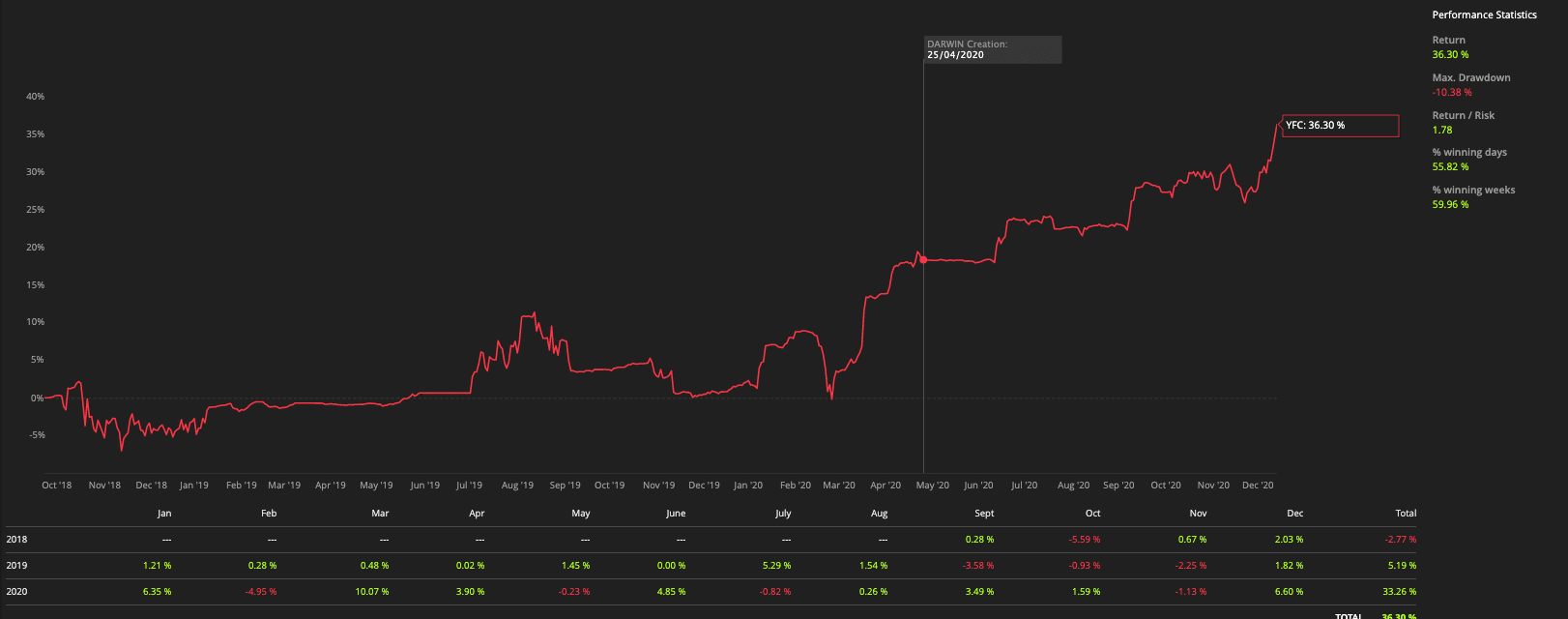

Having a workflow with StrategyQuant in the middle of it has helpded me make it work. This year, I replaced a portfolio I was running with all StrategyQuant algos I took through this workflow. The result is a portfolio that has won multiple rounds of funding with the well respected Metatrader broker Darwinex. And as I write this, the portfolio is currently 5th out of over 3500 other systems for December 2020.. if it can remain here, then it will be the 4th allocation of funding in just 6 months (funding is allocated every month)

So this is all thanks to StrategyQuant.. I really appreciate the product and the team for continually updating and improving it! Thank soooo much!

My trading system (or portfolio) is called YFC. Not sure if I can post the link to it so you can see it’s results live:

tomas262

4 years ago #268249

Hi,

great stuff, thanks for sharing and also for mentioning the hard work that is required but pays off 🙂

Waid

4 years ago #268276

Thanks for your sharing bro, glad to see that really work. From your perf. curve I think it is important to keep diligent working, strong mind, and patience.

clonex / Ivan Hudec

4 years ago #268285

Happy to see stories like this. Keep up good work !

clonex / Ivan Hudec

4 years ago #268286

Btw would be excellent to share ( if possible ) some basic steps from your workflow. And don’t forget : https://strategyquant.com/forum/topic/bump-official-community-team-chat-on-discord-over-402-member-already/

huangwh88

4 years ago #268295

Great to see your success! Do you think your sharp upturn in performance in 2020 was due to switching over to the SQ portfolio?

alanhere

4 years ago #268296

Great to see your success! Do you think your sharp upturn in performance in 2020 was due to switching over to the SQ portfolio?

Yes absolutely.. before it was all manual trading and I completely overhauled it… still work is not complete, need to keep watching it as markets change and need to swap out algos which start to fail in put in new ones which work..

huangwh88

4 years ago #268297

Great to see your success! Do you think your sharp upturn in performance in 2020 was due to switching over to the SQ portfolio?

Yes absolutely.. before it was all manual trading and I completely overhauled it… still work is not complete, need to keep watching it as markets change and need to swap out algos which start to fail in put in new ones which work..

If you dont mind sharing, how do you determine which algos are failing, and which ones should replace them?

alanhere

4 years ago #268298

Btw would be excellent to share ( if possible ) some basic steps from your workflow. And don’t forget : https://strategyquant.com/forum/topic/bump-official-community-team-chat-on-discord-over-402-member-already/

Yes, of course… I always test with multiple data sets and different settings..

After going through the whole process in StrategyQuant, I select the best ones to go into what I call incubation accounts.. these are running either small live accounts or demos for a couple of months at least to see results. Even after this process, I’d say only a small proportion trade as per the backtests (less than 10%). This, to me, is one of the biggest mysteries.. I can’t figure out which systems work live even after selecting only the ones which pass all the robustness tests without doing this incubation phase.

alanhere

4 years ago #268299

Great to see your success! Do you think your sharp upturn in performance in 2020 was due to switching over to the SQ portfolio?

Yes absolutely.. before it was all manual trading and I completely overhauled it… still work is not complete, need to keep watching it as markets change and need to swap out algos which start to fail in put in new ones which work..

If you dont mind sharing, how do you determine which algos are failing, and which ones should replace them?

I use the backtests as reference.. so in your backtests you will know the frequency of your trades, average percentage of winning trades, max concurrent wins and losses.. if your trading system is not conforming to these then it’s time to look to swap it out.

I have around 200 systems testing in live or demo accounts across over 30 broker accounts (and around 5 different regulated brokers). I tie them all to myfxbook and look at how they are doing by the magic number. This allows me to select a suitable working system to replace it with..

mattedmonds

4 years ago #268323

Thanks for sharing Alan. Love the idea of making profits on your account for trading funds on behalf of others. Looks like a great setup.

What sort of profit factor does a strategy require in backtesting for you to consider it?

kasinath

4 years ago #268379

Alan: this is fantastic, and great motivation!

Thanks for sharing Alan, I am on the same path that you were on. Since I got SQX over the summer I’ve spent countless hours learning, tweaking, refining.

I have so many questions. I might ping you off thread if that’s okay.

alanhere

4 years ago #268459

Thanks for sharing Alan. Love the idea of making profits on your account for trading funds on behalf of others. Looks like a great setup. What sort of profit factor does a strategy require in backtesting for you to consider it?

It’s not really profit factor.. I look at frequency of trades, win / loss of trades, shape of equity curve over longer term outside of my insample testing. Pick the best ones and put them on small live accounts to see how they perform.

alanhere

4 years ago #268460

Alan: this is fantastic, and great motivation! Thanks for sharing Alan, I am on the same path that you were on. Since I got SQX over the summer I’ve spent countless hours learning, tweaking, refining. I have so many questions. I might ping you off thread if that’s okay.

yes, i’ll try my best to answer you

ivan

4 years ago #268626

my experience or story is far worse than allan lee’s and its possible that i will scare off beginners, that’s why i hesitated to write

after some 3 years of generating and testing, i failed to make a single euro or eurocent, not even recover some of the investments, not to mention real profit

my best strategies were on timeframes ranging from M15 to H4. The daily timeframe is the only one i haven’t generated because simply forward testing on such huge timeframe, takes years

the pairs are in descending order of profitability: XAUUSD, GBPJPY and GBPUSD. Some very isolated cases, insignificant on EURUSD, USDCHF.

The best strategies tested for several months until some 20 closed trades, had 65 – 100 pips/trade and an average of 150 – 450 pips/month. Other less profitable which i kept, had some 30 – 50 pips/trade and 100 – 200 pips/month. Below this line, any strategy is garbage.

The number of final working strategies were 10 – 12, at the end of a complete generation process on most of forex pairs and timeframes. If we assume a ratio of 1 EUR/100 pips, that in theory would be translated into 30 EUR/month (3 EUR/strategy x 10 strategies). This ratio of 1 EUR/100 pips would be reasonable for most small beginner accounts with volumes of 0.01 and medium leverage. In theory, such a trading portfolio would double the account every 8 – 10 months. This is on paper, because in real life, there were always unexpected or unplanned hiccups unrelated to SQ software, like a broker deleting the history or unexplained differences in behavior.

I use this unit of measure, pips/trade or pips/year because its the easiest for beginners to grasp and to convert of all. Once you input the leverage and volume, you can easily convert this in exact sum for every trade.

This post and what i wrote is by no means a negative review of the software itself but a warning for not all beginners but for those who underestimate the complexity of trading itself and those who seek rapid and easy profit. I can assure them that this is not one of those solutions.

Timisoara, Romania

3900X 3.8 Ghz 12 cores, 64GB RAM DDR4 3000Mhz, Samsung 970 EVO Plus M.2 NVMe

mattedmonds

4 years ago #268628

I am having success using 1 minute to 15 minute timeframes. It provides the volume of trades required to get certainty of profit and likely drawdown over multiple years. The strategies that I am about to go live with are getting 12-18 trades per week per currency pair and I am about to launch with 6 currency pairs.

I am a big believer in using trading hours to refine a strategy. Finding that the same hours of trading are the most profitable across multiple currency pairs provides validation for the strategy and trading timeframes. I am getting results within 2-3+ profit factor range and a sharpe ratio of 5+ across the 6 pairs using the exact same strategy with the only modifications that I have optimized being stop loss settings, otherwise they are identical across each pair.

Note that I am starting with an idea of a strategy for what I am trying to create in Algowizard, i.e. breakout, range trading, swing trading, momentum continuation etc, then looking at charts to find combinations of indicators to define what I am trying to achieve on charts, for ideal entries and exits then backtesting that strategy. I personally don’t see much point in testing random combinations of indicators, hoping to find one that works through sheer volume of testing.