Documentación

Aplicaciones

Última actualización el 22. 9. 2020 by Tomas Hruby

Resultados - Métricas de análisis de la estrategia

Contenido de la página

Total Profit

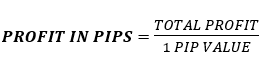

Profit En Pips

AVG anual Profit

Esta cifra indica el beneficio medio anual.

Rentabilidad anual media %

CAGR

Es un porcentaje de revalorización (p.a.).

Ratio de Sharpe

Se utiliza para ayudar a comerciantes para comprender la rendimiento de una inversión en comparación con su riesgo. El ratio es la rentabilidad media obtenida por encima del tipo sin riesgo por unidad de volatilidad o riesgo total.

Factor de beneficio

Se trata de un indicador muy popular. Básicamente requerimos un valor de 1,3 o superior.

Ratio rentabilidad/DD

Este ratio se utiliza mucho. Es bueno considerar también un riesgo (en este caso drawdown).

Porcentaje de victorias

Este indicador suele oscilar entre 40 y 60 %. Incluso la estrategia con WP inferior a 50 % puede estar bien - depende de Risk Reward Ratio (Stop Loss vs. Profit Target), es decir, pérdida o ganancia potencial.

Desenfundar

Dice cuál es la mayor bajada de capital (fondos propios).

% Draw Down

Este índice muestra cuál es el porcentaje máximo de caída del capital.

AVG diario Profit

AVG mensual Profit

Comercio medio

Precisamente, se trata de un beneficio medio por operación.

Anual% / Max DD%

R Expectativa

Se trata de una operación media teniendo en cuenta el riesgo (pérdida potencial máxima de la operación).

Puntuación de la expectativa de R

Este indicador amplía R EXPECTANCIA en un número medio de operaciones al año.

Número de calidad STR

= Número de Calidad de la Estrategia.

Es una métrica de rendimiento desarrollada por Van Tharp; mide la calidad de un sistema de negociación. La interpretación estándar de SQN es:

- Puntuación: 1,6 - 1,9 Por debajo de la media, pero negociable

- Puntuación: 2,0 - 2,4 Media

- Puntuación: 2,5 - 2,9 Bueno

- Puntuación: 3,0 - 5,0 Excelente

- Puntuación: 5,1 - 6,9 Excelente

- Puntuación: 7,0 - Sigue así y puede que tengas el Santo Grial.

Puntuación SQN

El NÚMERO DE CALIDAD STR no tiene en cuenta la duración del periodo de prueba ni el número de operaciones producidas. Por lo tanto, también existe SQN SCORE.

Ratio de victorias/derrotas

Ratio de pago

Dice cuántas veces la ganancia media es mayor que la pérdida media.

AHPR

Z - Puntuación

Describe la posición de una puntuación bruta (COMERCIO MEDIO) en términos de su distancia a la media, cuando se mide en unidades de desviación estándar. La puntuación z es positiva si el valor se sitúa por encima de la media, y negativa si se sitúa por debajo de la media.

Z - Probabilidad

Esta es otra estadística valor - probabilidad derivada del Z-SCORE y la distribución Z.

Expectativa

Desviación

Exposición

Dice cuál es el porcentaje de estar en la posición en toda la muestra.

Estancamiento en días

Estancamiento en %

Esto dice cuál es el porcentaje máximo de creación de nuevos altos por equidad en el tiempo.

Bruto Profit

Pérdida bruta

Ganancia media

Pérdida media

Gana Max Consec

Pérdidas máximas por consumo

Simetría

compara el beneficio para el lado largo frente al beneficio para el lado corto.

Simetría comercial

compara el número de operaciones largas frente a las cortas.

NSimetría

muestra '-1' si el lado largo es rentable mientras que el corto está perdiendo dinero (o al revés). Si ambos son rentables o pierden dinero NSymmetry es '0'.

Estabilidad

es una fórmula propia que utiliza la regresión lineal. Básicamente evalúa cómo de recta es la curva de la equidad. Si fuera una línea recta ascendente, la Estabilidad sería 1.

Nota importante: Recuerde que todos los indicadores mencionados proceden de un backtest. No garantizan los mismos resultados en una cuenta real. Es necesario realizar una prueba de robustez adecuada para comprobar la calidad de las estrategias.

¿Le ha resultado útil este artículo? El artículo era útil El artículo no era útil

He observado que no hay una definición de RSquare en esta sección.

Además, no estoy seguro de si en la tabla de resultados si RSquare es sólo para la parte de formación de la tabla de resultados son también para la parte InSample también?

Por último, cuando intenté añadir RSquare a la parte OOS de la tabla de resultados, seguía remitiendo a la parte de entrenamiento y a la parte InSample.

Gracias por su atención en este asunto.

¿Puede indicarnos a soporte@Kevin.com con más detalles y un ejemplo del problema? Comprobaremos

Estabilidad - Interesante definición. ¿Comparable a R-cuadrado? Entiendo que la estabilidad es una fórmula patentada, pero ¿podría explicarnos la diferencia entre R-cuadrado y estabilidad?

Además, ¿es aconsejable utilizar Estabilidad como filtro personalizado, por ejemplo, Estabilidad > 0,8?

Gran plataforma.

Gracias por todo su trabajo.

Rojo

Haga clic en este enlace para obtener una explicación más detallada de cada punto.

También puede hacer preguntas directamente en ....

ChatGPT lo explica

Vamos a desglosar estas métricas de trading de una forma más sencilla y detallada, a la vez que explicamos para qué sirve cada una y los rangos típicos asociados a ellas: 1. Total Profit Explicación: Es la cantidad total de dinero que has ganado con tu estrategia de trading. Es la suma de todas las operaciones ganadoras menos las pérdidas. Uso: Le ayuda a ver cuánto ha ganado en total. 2. 1TP9Ganancia en Pips Explicación: Mide el beneficio total en pips (la unidad más pequeña de movimiento en los pares de divisas). Muestra la ganancia o pérdida total en pips de todas las operaciones. Utilización: Útil para... Leer más "