Documentation

Applications

Last updated on 22. 9. 2020 by Tomas Hruby

Results – Strategy analysis metrics

Page contents

Total Profit

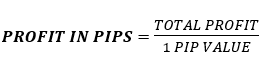

Profit In Pips

Yearly AVG Profit

This number indicates average profit per year.

Yearly AVG % Return

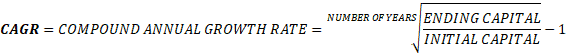

CAGR

It is an appreciation percentage (p.a.).

Sharpe Ratio

It is used to help traders to understand the return of an investment compared to its risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk.

Profit Factor

This is a popular indicator. We basically require a value 1.3 or higher.

Return/DD ratio

This ratio is widely used. It is good to also consider a risk (in this case drawdown).

Winning Percentage

This indicator usually ranges between 40 and 60 %. Even strategy with WP lower than 50 % can be fine – depends on Risk Reward Ratio (Stop Loss vs. Profit Target), i.e. potential loss or win.

Draw Down

It says what is the biggest downswing of capital (equity).

% Draw Down

This index shows what is the maximum percentage downswing of capital.

Daily AVG Profit

Monthly AVG Profit

Average Trade

Precisely, this is an average profit per one trade.

Annual% / Max DD%

R Expectancy

It is an average trade with consideration of risk (maximum potential loss of trade).

R Expectancy Score

This indicator extends R EXPECTANCY by an average number of trades per year.

STR Quality Number

= Strategy Quality Number.

It’s a performance metrics developed by Van Tharp; it measures the quality of a trading system. Standard interpretation of SQN is:

- Score: 1.6 – 1.9 Below average, but trade-able

- Score: 2.0 – 2.4 Average

- Score: 2.5 – 2.9 Good

- Score: 3.0 – 5.0 Excellent

- Score: 5.1 – 6.9 Superb

- Score: 7.0 – Keep this up, and you may have the Holy Grail.

SQN Score

STR QUALITY NUMBER does not consider the length of testing period and number of trades produced. Therefore, there is also SQN SCORE.

Wins/Losses ratio

Payout ratio

It says how many times is the average win bigger than average loss.

AHPR

Z – Score

It describes the position of a raw score (AVERAGE TRADE) in terms of its distance from the mean, when measured in standard deviation units. The z-score is positive if the value lies above the mean, and negative if it lies below the mean.

Z – Probability

This is another statistical value – probability arisen from Z-SCORE and Z-distribution.

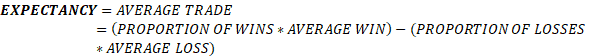

Expectancy

Deviation

Exposure

It says what is the percentage of being in the position in the whole sample.

Stagnation In Days

Stagnation In %

This says what is the maximum percentage of creating new high by equity in time.

Gross Profit

Gross Loss

Average Win

Average Loss

Max Consec Wins

Max Consec Losses

Symmetry

compares profit for the long side vs profit for the short side.

Trades Symmetry

compares number of trades long vs short.

NSymmetry

shows ‘-1’ if the long side is profitable while the short is losing money (or opposite). If both are profitable or losing money NSymmetry is ‘0’.

Stability

is a proprietary formula which uses linear regression. It basically evaluates how straight the equity curve is. If it was a straight rising line, Stability would be 1.

Important note: Please remember that all above-mentioned indicators arise from a backtest. It does not guarantee the same results on a real account. It is necessary to do a proper robustness testing to check quality of strategies!

Was this article helpful? The article was useful The article was not useful

I noticed that there is not a definition for RSquare in this section.

Also, I am not sure if in the results table if RSquare is just for the training portion of the results table are also for the InSample portion too?

Lastly, when I attempted to add RSquare to the OOS portion of the results table, it was still referring back to the training portion and the InSample portions.

Thank you for your attention on this matter.

Can you please let us know to support@Kevin.com with more details and example for the issue? We will check

Stability – Interesting definition. Comparable to R-Square? I understand that Stability is a proprietary formula however, can you give any insight as to the difference between R-Square and Stability.

Also, is it advisable to use Stability as a custom filter, say Stability > 0.8 for example?

Great platform.

Thanks for all your work.

Red