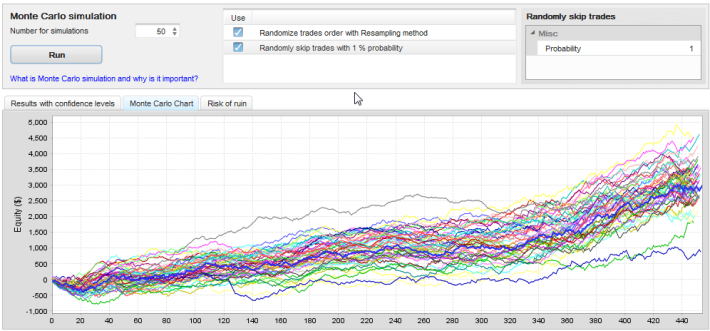

Monte Carlo Simulations

give you an excellent view of how robust your strategy is and how it is vulnerable to changes in the conditions of the market.

Přejít k obsahu | Přejít k hlavnímu menu | Přejít k vyhledávání

give you an excellent view of how robust your strategy is and how it is vulnerable to changes in the conditions of the market.

Runs on Windows 10/8.1/7

Find out if your strategy really works and if it has the potential to be profitable in the future, or if it’s overoptimized and can easily fail in real trading.

Historical results of the strategy give us an idea, how the strategy behaved in the past and to some extent certain expectations for the future. However, the market can change in the future and therefore it’s necessary to measure how the strategy is vulnerable to changes such as market cycles, sequence of transactions, etc. To do this, Monte Carlo analysis is used. It helps us get the realistic idea of what we can expect from the strategy.

The main principle of the Monte Carlo analysis is that many simulations are run, each time with a small change. The more simulations we run, the more reliable results we get.

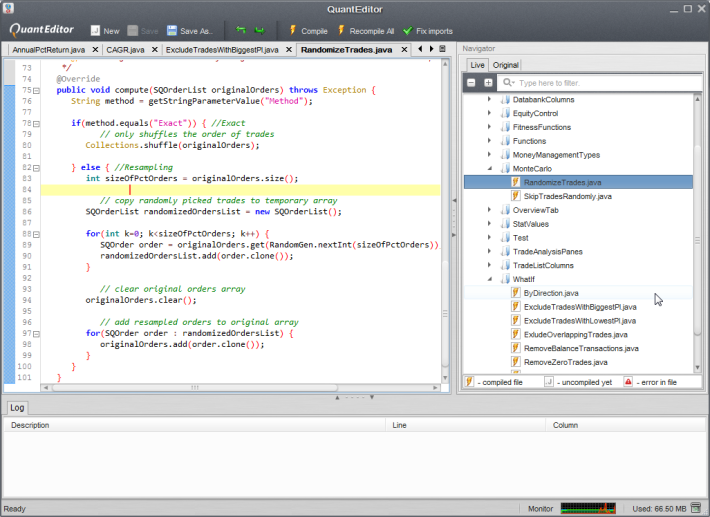

Every Monte Carlo simulation method is implemented as a simple code snippet snippet with full source code provided.

You can easily create your own simulations with some basic programming skills using the built-in QuantEditor tool.

QuantAnalyzer