Features

Explore all the features of new StrategyQuant X.

Přejít k obsahu | Přejít k hlavnímu menu | Přejít k vyhledávání

Explore all the features of new StrategyQuant X.

Runs on Windows 10/8.1/7, Mac, Linux, Windows Server.

Integrated free high quality data download for forex (source Dukascopy) and stocks (Yahoo Finance).

Start right away, there’s no need for any external tool to work with the data.

Optional Data subscription for futures and equities.

StrategyQuant has its own very fast backtesting engine that can make thousands of backtests per second – depending on your data and test precision. This allows SQ X to generate and review tens of thousands strategies per hour.

The backtesting engine was made to match exactly backtests in your trading platform, while being few times faster.

No-code approach. You don’t need programming skills to start trading algorithmic strategies.

With StrategyQuant you can build new algo strategies with a click of a few buttons.

Generate strategies that look at multiple charts – for example trade on H1 timeframe, and look also for signals confirmation on H4 and D1 timeframes.

Or trade on EURUSD and check also indicators or price data on GBPUSD and USDCHF charts. You can configure how many signals should be generated for every chart, and what its properties will be.

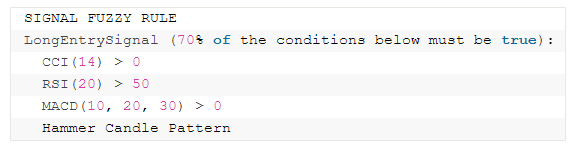

StrategyQuant supports all standard technical indicators (like CCI, RSI, MACD and so on). It also supports different candle formations, 4 types of trade entries and 6 types of exits, and the list is continuously growing.

What’s more – you can easily extend StrategyQuant with your own favorite indicator or building block – both visually in AlgoWizard editor (Custom blocks) or by making your own snippet.

You can even ask us or our partners to do so.

Output full source code of your strategy, nothing is hidden.

Platforms supported: MetaTrader 4, MetaTrader 5 (hedging and netting mode), Tradestation, MultiCharts, JForex

An important part of StrategyQuant features are build-in tools and checks to ensure the generated strategies are not overfitted to existing data – in other words that they have real edge and will continue to work also in the future.

Robustness tests (cross checks) are integrated into the strategy generation process, you can turn them on / off with a click of a button.

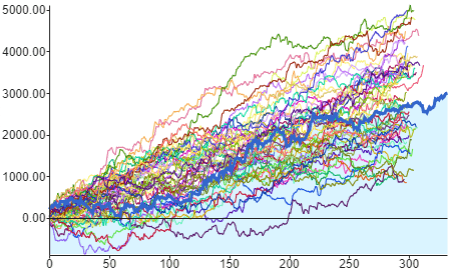

Two separate Monte Carlo tests with 9+ different simulation types allow you to simulate the behavior of your strategy with different random variations.

You can incorporate Monte Carlo tests directly into your building workflow and automatically reject strategies that don’t pass the Monte Carlo tests.

You can even extend this functionality with your own simulation model or download existing user extensions.

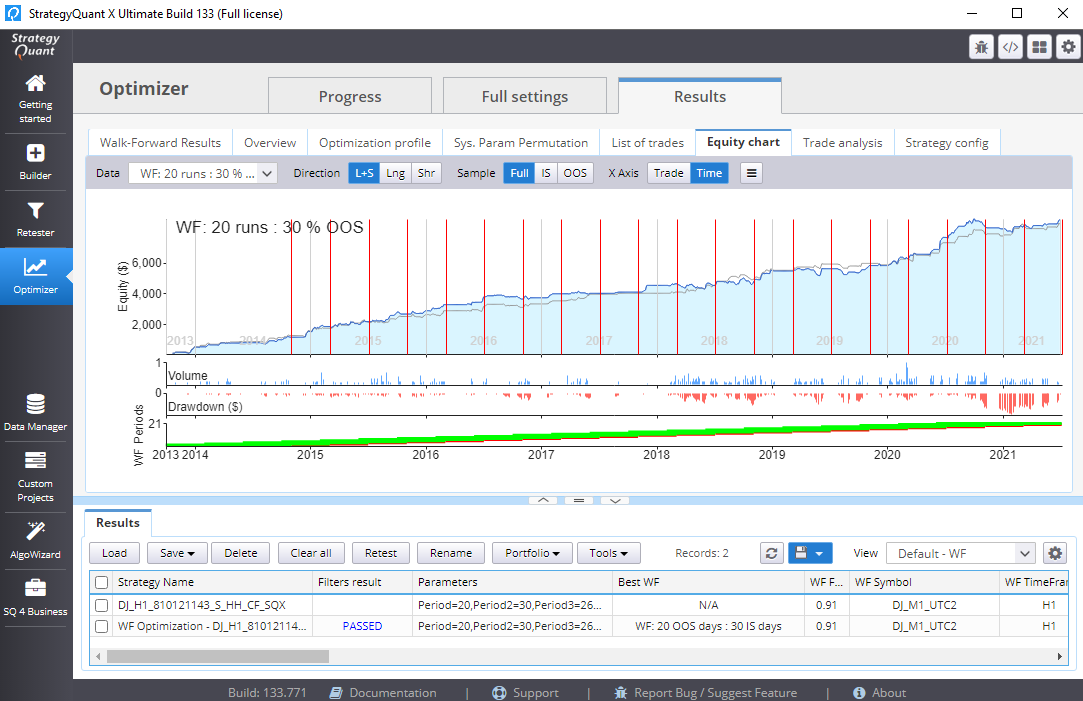

Build-in Optimizer allows you to optimize your strategies either in a simple way, or

in Walk-Forward mode.

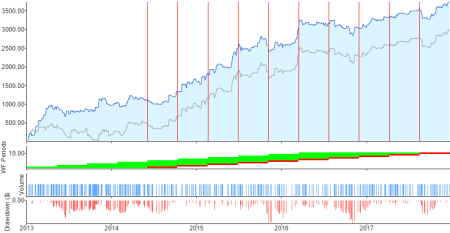

Equity chart is displayed for both original and optimized strategy with al the Walk-Forward periods.

You can verify if there are clusters of “optimal” and stable parameters for your strategy with Walk-Forward Matrix (cluster analysis).

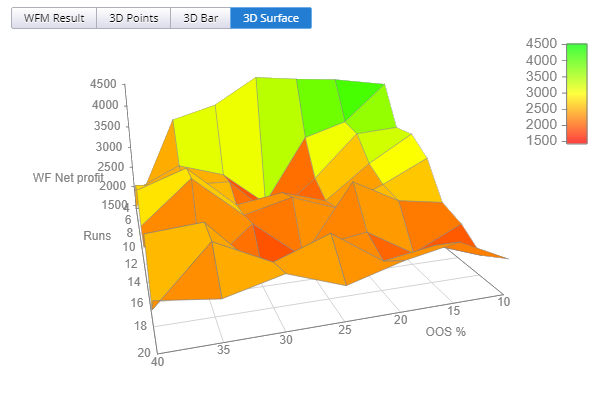

When you run WF Matrix optimization StrategyQuant will give show a 3D view of results for all the Walk-Forward combinations used in matrix.

You can quickly spot local maximums, minimums and if the results are clustered in some areas.

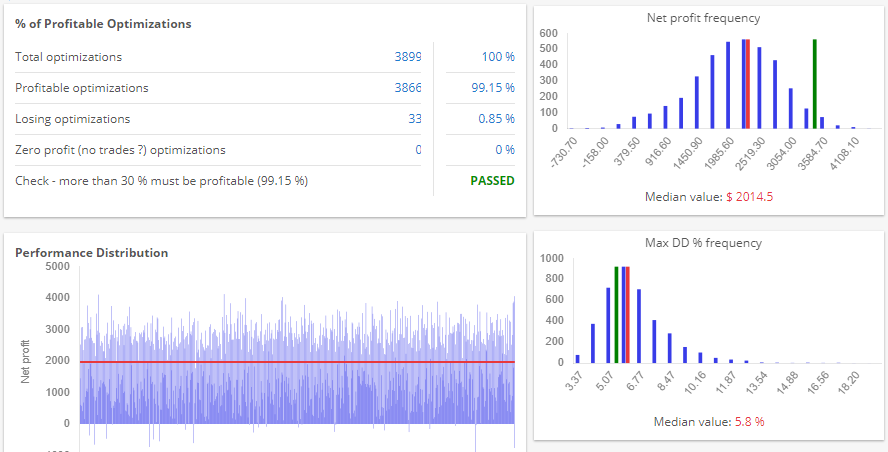

System Parameter Permutation (SPP) and Optimization profile are two advanced strategy robustness strategy tests created originally by Dave Walton and Robert Pardo.

They are now included also in StrategyQuant, and can be used to manually or automatically evaluate the strategy robustness.

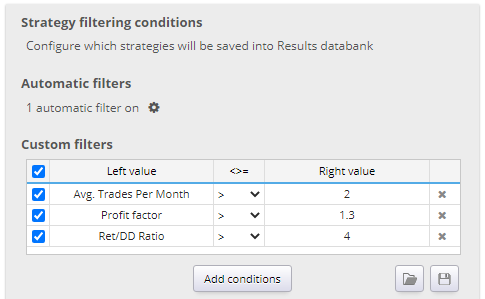

Use advanced filtering to let the program automatically filter out unsatisfactory strategies.

This way StrategyQuant can run in fully-automatic mode working for hours or even days without you needing manually check every generated strategy.

Filtering is possible for virtually every metric computed during backtest or robustness tests, including optimization and Walk-Forward.

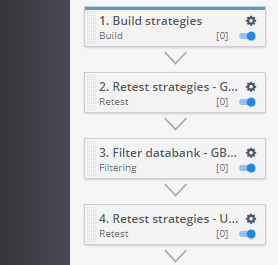

You can automatize your workflow in Builder, or use Custom projects to build your own unique workflow with as many steps as you like.

You can have multiple builds, retests, optimizations and other tasks chained one after each other to achieve exactly what you want – and let it run in a fully automatic mode.

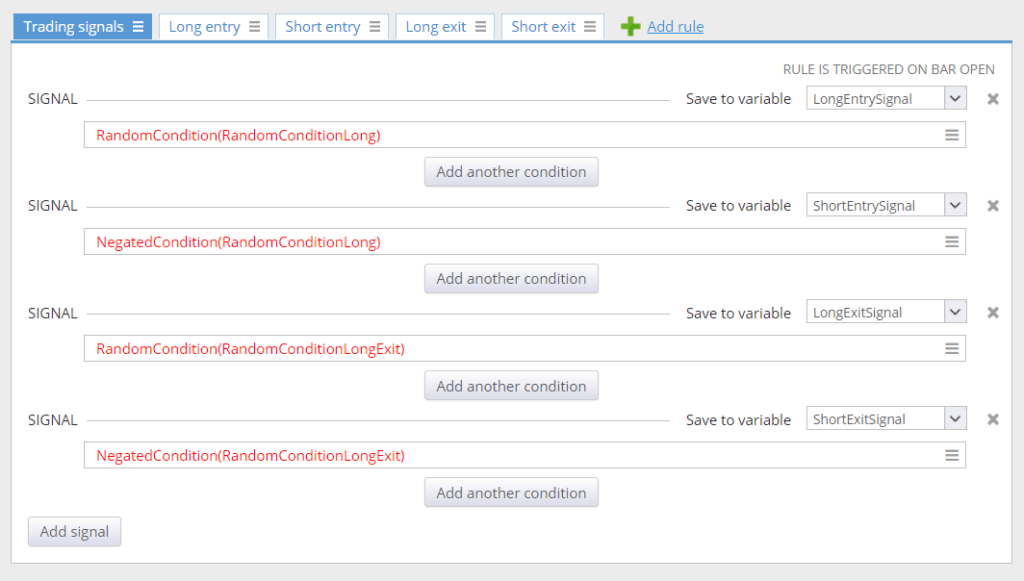

One of the main advantages of StrategQuant X is ability to generate strategies with your own custom “format”.

StrategyQuant generates strategies using strategy templates – they are strategies that use special placeholder blocks in certain parts (we call these Random placeholders) and StrategyQuant then randomly generates blocks that fill these placeholders.

Fuzzy logic allows you to create strategies where logic is not exact, but “fuzzy” – you define how big percentage of the conditions has to be true in order for signal to be valid.

This feature provides a new class of strategies

ATM feature allows you to configure (or search for) multiple exits of your strategy to scale out a trade.

Use of multiple exits could improve your strategy results, it depends on exact strategy and configuration.

A preliminary testing suggests that using even a very simple ATM configuration can improve 10-30% strategies right away.

Custom analysis feature allows you to extend StrategyQuant to perform a custom analysis of the generated / retested /optimized strategies and whole databanks.

This allows you to run your own custom computations and filtering and even call external programs or scripts for example in Python to do that.

Easily download high quality history data from multiple sources, including tick data for forex and minute / EOD futures and equity data.

Simulate portfolios trading by grouping multiple strategies into a portfolio - with multiple portfolio models.

Improve your existing strategies or only their parts using the same build process based on machine learning.

Retest or Optimize existing strategies on different markets, with different settings, and even re-run all the robustness tests for them.

Display candle chart including all used indicators and trades as they were filled, to spot trading patterns visually.

Use unlimited number of Out of Sample periods and perform advanced filtering based on results in each OOS period separately.

Maximum open profit or loss or daily equity are automatically computed and displayed in equity chart.

A functionality in StrategyQuant that allows you to find strategies that will complement your existing portfolio and are not correlated with your existing strategies.

Automatic detection of common flaws and its reporting for every generated strategy can help you filter out bad strategies.

Built from the scratch as an open, extendable platform and majority of the functionality is implemented using plugins or snippets and can be extended.

Our environment of trading tools - StrategyQuant, QuantAnalyzer, QuantDataManager, AlgoWizard covers all aspects of strategy generation, trading and tracking.

StrategyQuant X is under continual development, we are releasing a new version every few months and we keep on adding new exciting features to improve SQ even further!