Documentation

Applications

Last updated on 22. 4. 2020 by Mark Fric

Merge / Split Portfolio

Page contents

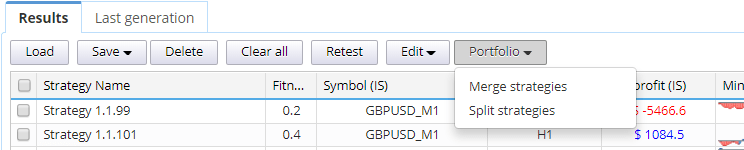

Merge / Split functionality is available as an action above the databank:

Merge strategies

Merge strategies can combine multiple individual strategies into one using one of the possible ways. To use it, select a few strategies and choose this option.

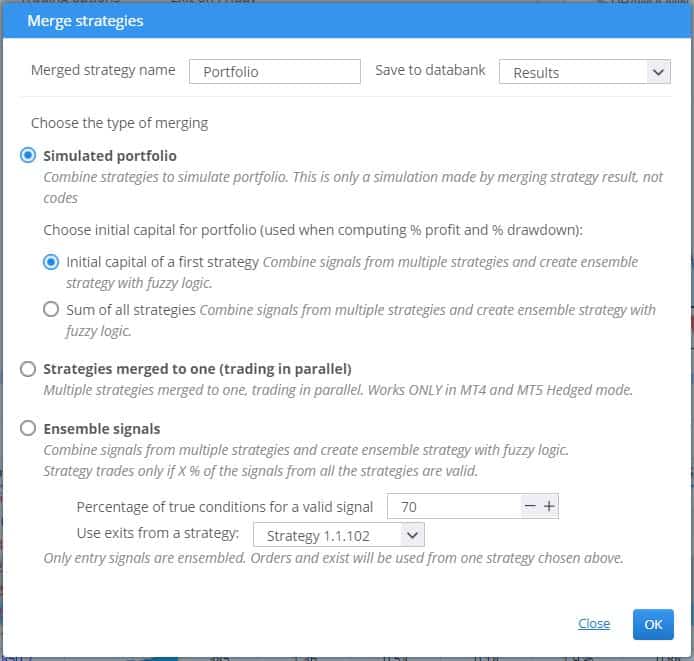

It will open this dialog:

You can choose Name of your new merged startegy, by default it is Portfolio. You can also choose to save this new portfolio strategy to another databnk than your actual one in Save to databank option.

There are three types of merging possible:

Simulated portfolio

Thsi means that trades of your chosen strategies are merged to one, and portfolio statistics are computed from these merged trades. It simulates how these strategies would trade together – but it considers every strategy to trade independently from the other.

This is an artifical portfolio created only by combining orders of individual strategy components. It cannot be backtested, but it shows portfolio statistics.

Strategies merged to one (trading in parallel)

EXPERIMENTAL feature. This type of merge will create one compounded strategy that has trading rules of each of the individual strategies.

It can be used in MetaTrader 4/5 to deploy just this one merged strategy to trade multiple individual “strategies” in parallel. You will be able to specify symbols and timeframes for every individual strategy independently.

Note – trading options (Exit on Friday, Limit Trading Range) are global, they are set for the merged strategy and will be valid for all the individual strategies included. So this type of merge wouldn’t wotrk if you’d want to merge strategies that use different trading options.

Ensemble signals

EXPERIMENTAL feature. A special type of merge that uses one main strategy, and updates its entry conditions with entry conditions from all other selected strategies using a FUZZY logic.

So this sarategy will be trading only if a given % of all entry signals are valid. In theory this has a potential to improve trading results, it depends very much on the actual strategies.

Split strategies

Split functionality is simple – it splits an existing portfolio created by Merge to its individual components. Note it will work only on portfolios created in SQ Build 127 or newer.

Was this article helpful? The article was useful The article was not useful

Love the merge feature. It works well on MT4.

One issue i have, though, is when I generate the MQ4 for a portfolio of strategies that size lots based on % of account.

When i run a backtest for these combined strategies MT4, i see all that my order lots all have the same size, of 0.1.

Is this expected behaviour?

Hi, did you set MM model on the code export? You can choose the required one

When I am merging the strategies, only two as of now, I’m getting an “N/A” for all my data out puts. It isn’t merging the strategies. “Strategies merged into one”, and “initial capital of first strategy”.

I have ran these two strategies though retesting and made sure the passes on “Real Tick” data.

Am I doing something wrong?

Which version do you use? Please update to the latest https://strategyquant.com/download

Hello SQ team, my question is, can I join strategies with different timeframes? In that case, what timeframe should I put on MT4 as the chart timeframe?

Thanks a lot!?

You should only merge strategies trading the same timeframe

hi there is limitation in number of strategy for combine in one strategy??

thanks

Hi,

it makes sense to merge only limited number of strategies. The performance goes down fast with increasing number of strategies in a portfolio. We recommend to merge no more than 10 strategies …

thanks for you help

if I have daily strategy with few trade you suggest again less than 10 strategy in one portfolio

thanks for you help

if I have daily strategy with few trade you suggest again less than 10 strategy in one portfolio

and also I made a portfolio of 10 strategies all same symbol and same Time frame and same option and when I save it for MT4 it generated well and compiled with no error but for back test portfolio it has not any output (strategy one by one back tested successfully and my version is last version)

The same experience with my portfolio, you cannot trust the portoflio merge, because teh trade result is different (more bad) as you trade every strategy seperate in MT4. I test many portfolios with not more as 10 single strategies, but alway the same result, in the portfolio not all trades would be executed.

Hi, simulated portfolio, both portfolio created by initial_cap & sum, they show exactly same total profit and charts. I don’t quite understand the outcome and your description. would you please elaborate how they are different? otherwise, there must be bugs,

我不太明白将多个策略合并为一个(平行交易)策略的设置。它每次都失败,你有什么教程吗?

请通过 support@Kevin.com 联系我们的支持人员,我们将为您提供帮助

Hi! I tried to merge WF Results merging 2 WF Matrix Strategies, but I am not able to set the desired combination of runs and % OOS. What I am looking for is to evaluate how 2 Strategies work together. I will run them separately, so I don’t need to generate code for the Portfolio strategy. I just need to add these WF Matrix Strategies together to see the aggregated results. For example: Strategy 1.212.321 – 4 runs 10% OOS is the best fit according to the WF Matrix Strategy 4.011.119 – 10 runs 5% OOS is the best fit… Read more »

Hi guys. The portfolio feature and testing works great. However, when I try to save portfolio of strategies, it only save 1 strategy, even when I try copy and save it to another databank, only one of the portfolio strategies shows up. When I try to split portfolio strategies, I get message that it was successfully done, but nothing happens. Am I doing something wrong?