Documentation

Applications

Last updated on 14. 5. 2015 by Mark Fric

Money Management Simulation

Page contents

New Money Management Simulation feature in Quant Analyzer allows you to simulate trading your strategy with different money management options – for example you can compare the trading results by using fixed lots or risk % of account.

The use of Money Management simulator is very simple.

Step 1: Load some strategy

First you have to load some backtest or strategy report.

This is a standard load process, we won’t describe it here.

Step 2: Configuring Money Management simulations

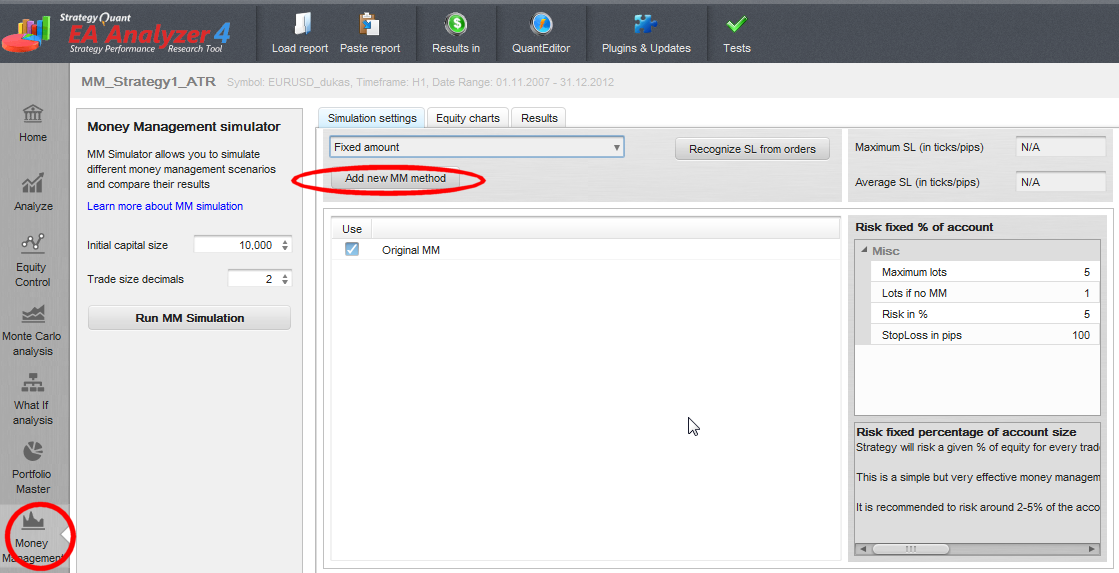

Now we can switch to Money Management tab.

We have to configure some MM simulation methods – we can do it by choosing the MM method from select box and clicking on Add new MM method button.

Let’s choose Risk fixed % of account.

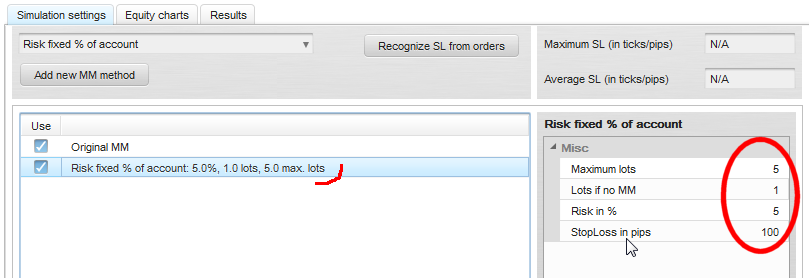

The new simulation method was added, now we have to configure its parameters in the property pane on the right.

Every method has a different set of parameters, the most important parameters for Risk fixed % of account method are:

- Risk in % – this is the % of account equity we want to risk per every trade

- Maximum lots – maximum cap on traded lots

- StopLoss in pips – in this type of money management risk is determined by Stop Loss – the strategy will trade with so many lots that if stop loss is hit, it will never lose more than predefined % of the account.

Risk per trade

Some MM methods, especially Risk fixed % of account and Risk fixed amount have to determine the risk of every trade in order to compute the correct trade size. Risk per trade is usually the Stop Loss – maximum loss that can occur on the trade.

How can the Money Management know what Stop Loss was used for every trade?

We have to realize that Quant Analyzer DOESNT RUN A NEW BACKTEST, it “only” analyzes existing trades, so it can only work with the information that were loaded from the report.

There are two possibilities, depending on the type of report you imported and its options:

- either Stop Loss is set for every trade – some reports contain this information, in this case it was loaded by Quant Analyzer, and it is available

- or Stop Loss is set only for some orders, or never. MM will then not be able to determine the exact Stop Loss for each trade

In the second case MM will have to use some other way to determine the risk per every trade.

Usually, either maximum or average loss is used for orders that don’t have SL defined. This is the StopLoss in pips settings.

Recognizing Maximum and Average Stop Loss

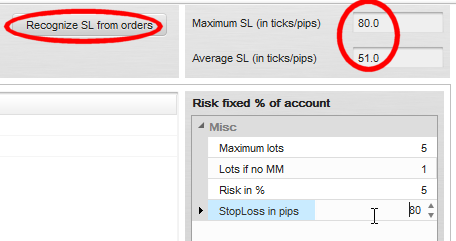

Quant Analyzer has a simple function for this.

Just click on Recognize SL from orders and QA will recognize max and avg SL by going through all the orders of the loaded report and display it in the section on the right.

You have to then copy either max or average SL value to the StopLoss in pips setting of the money management method.

Adding more money management simulations

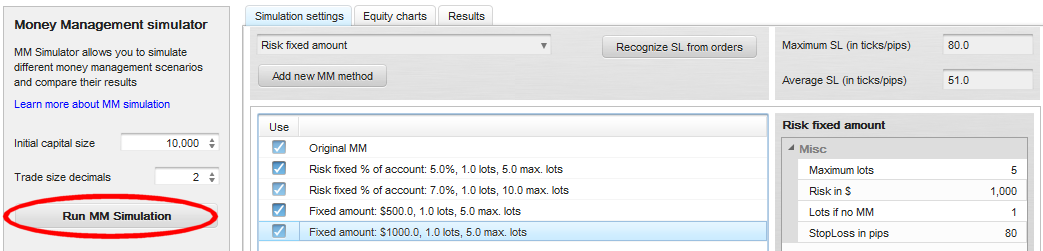

We can add few more MM simulations, even add the same MM method with different parameters. In the end, our setting could look like this:

Then we can click on Run MM simulation to run the actual simulation. Quant Analyzer will now go through the strategy orders and apply each MM method to it.

Then it will display results in Equity charts and Results tabs.

Step 3: Evaluating the results

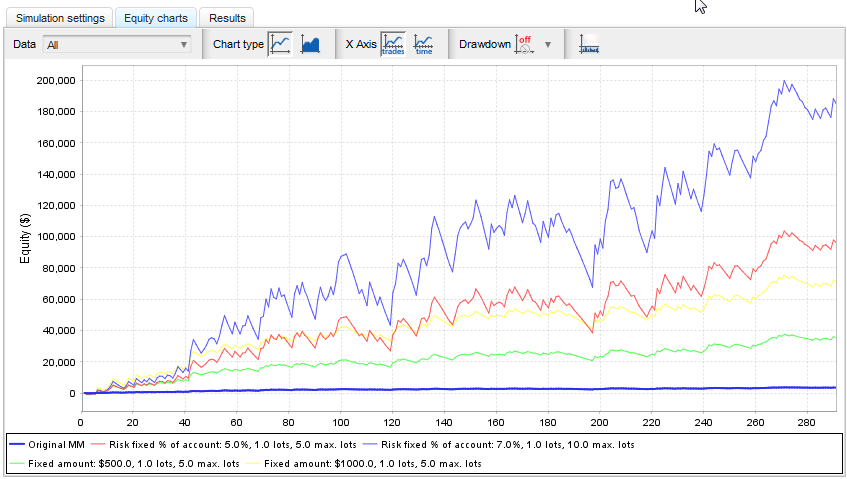

By switching to Equity chart we can see equity of every MM simulation, compared to the original equity of the strategy.

as expected, we can see that Risk fixed % of account has the best performance, but also the biggest drawdowns.

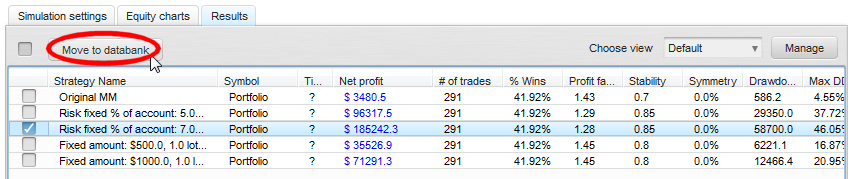

When we’ll switch to Results, we can see the results in databank – you can switch the view to display the columns you are interested in.

There is also an useful Move to databank button that will copy the MM simulation result to normal databank, so you can analyze it further in the program.

Conclusion

Simulating different money management methods allow you to test how your strategy would behave with different money management, or just with different MM parameters.

It is powerful tool that could improve your trading by increasing profits or reducing risks, without making changes in trading strategy itself.

As with anything, it has to be used with caution. Always retest your strategy with the new money management also in your trading platrorm. Remember that Quant Analyzer does only simulations, not actual backtesting.

Extendability

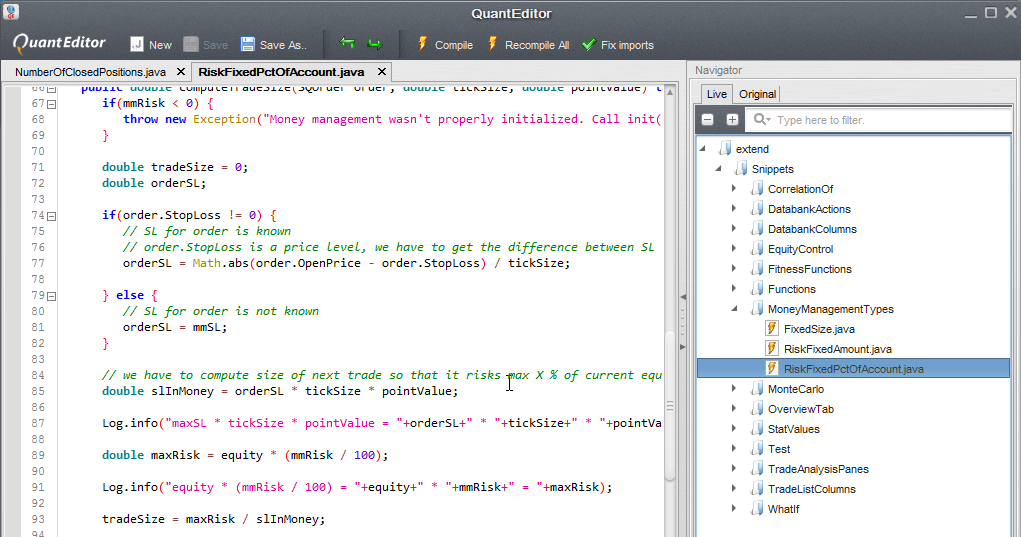

the best thing is that Money Management methods, like most of other things in Quant Analyzer 4 are extendable. There are three default MM methods, but you can easily write your own in QuantEditor in Snippets -> MoneyManagementTypes.

We will provide more documentation and samples, as well as more MM methods implementations in the near future.

Was this article helpful? The article was useful The article was not useful

Hi Dear, My name is Shweta Dubey and work as an entrepreneur, for one of my clinets I would like to have a permanent Forex and casino casino related article in the new inner page with the text link on your website. Kindly let me know article on which theme with respective text link you can place on your website and what will your charge me for that. Other than that if you are looking for media buying, contact writing or digital marketing services, please do let me know. Looking for a good business terms with you. Thanks and regards… Read more »