Documentation

Applications

Last updated on 26. 2. 2019 by Kornel Mazur

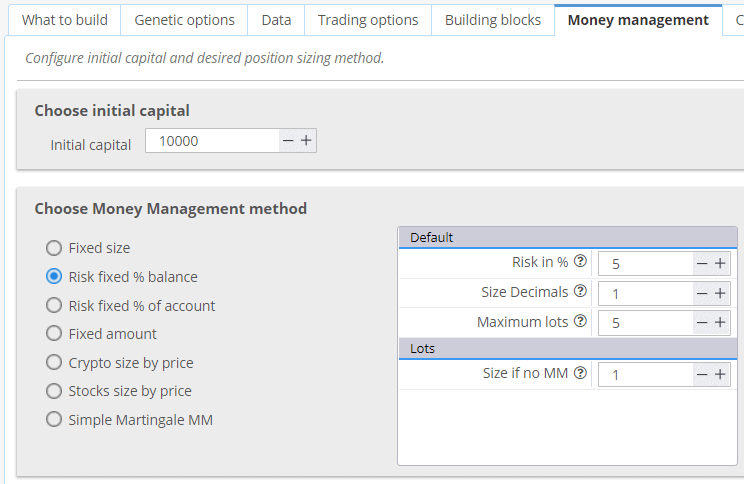

Settings – Money management

Page contents

Money management (or position sizing) specifies how many lots or shares are traded on each trade.

StrategyQuant has flexible and extendable money management options that can be used in the program and later also in real trading in your trading platform.

Brief description of different money management types:

Fixed size

strategy will trade with fixed number of lots. This is recommended setting when you generate new strategy, because it gives you clear overview of strategy real performance.

Fixed amount

strategy will risk a fixed amount of money for every trade. This is basic money management without compounding. It can be used to test real performance of strategies where Stop Loss is based on volatility (ATR), or if you want to compare the performance of strategies with different Stop Loss.

Risk fixed % of account

advanced money management that is recommended for real trading. The strategy will risk a given % of equity on every trade. This is simple, but very effective money management that will allow the strategy to increase number of lots as your account grows. It is generally recommended to risk maximum 2-5% of account equity per one trade.

Risk fixed % of balance

Like Risk fixed % of account, but it uses account balance instead of equity.

Account balance illustrates your closed trades Profit/Loss, while Equity is the real-time calculation of Profit/Loss, considering both open and closed. Positions.

Stocks size by price

This position sizing method is used especially used for stocks. Use account balance forces SQ to use the current account balance instead of the initial capital set.

Crypto size by price

Size computed as Balance / Asset Size. Position sizing method specifically for crypto trading – you have to specify the exact decimal numbers for rounding.

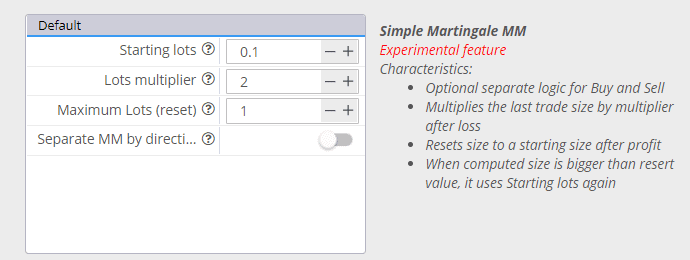

Simple Martingale MM

Position sizing that uses Martingale approach to increase positions after a loss.

Was this article helpful? The article was useful The article was not useful

Good morning, I am tring Strategy quant X and I am tring to export a strategy in mt4 with a money managment that consists of a % of the balance or the account( is the same for me) , it is a forex cross so i use 2 decimals, in SQ works but on the mt4 the % doesn’t work on the backtest and on the market (demo), the EA uses always fixed size on mt4.

Why?

Many thanks

Gave this section a thumbs down. Would liked to have seen a more detailed explanation (including examples) of how the Martingale option works.

Thank you.

Red

Hi, it is simple. After a losing trade it multiplies the previous lot size by the ‘Lots Multiplier’. Once the last size reaches ‘Maximum Lots’ it is reset for the next trade

Hello, I am using StrategyQuantX 137.1749 build and there is an issue with Money management. When using Risk fixed % of account OR Risk fixed % of balance the program ALWAYS defaults to Size if no MM option. I took a strategy from the Builder module into the Retester module, using a fixed size of 100. Next, I created a new databank in Retester module and changed the MM rules to % of Balance, setting the risk at 5%, size in decimals (0 for stocks) and size if no MM to 98. All the trades were executed with this fixed… Read more »

You have set your SQX incorrectly very likely. Please ensure your strategies have stop-loss included. Without pre-defined risk for a trade, the money-management method cannot be used

Hi, I struggle with this issue as well (Risk fixed % of balance) 100% when trying to build strategies for DAX an on/off for other indices. It will always default to ‘Size if no MM option.

Stop loss settings: min. 0.5 max 0.5 (tried with 2 for min and max as well)

Tested it on B. 136.1451, B. 138.1837.

Any idea if I’m missing something or if this is a bug?

Make sure your strategies do have stop-loss included. If not then MM lot size cannot be calculated hence “Size if no MM” will be used

Hi

I have a capital management plan that is not included in Strategy Quant. How can I add or handle them?

You can add a new MM method using CodeEditor. See the example https://strategyquant.com/codebase/atr-volatility-money-mannagement-sizing/

Hi! How are you? I have a question: When I compute for a fixed % in balance, it trades with lot size, how can I fix this? I want to see the curve using a fixed % in balance for MM.

Thak you!

Hello.I have some problems with the lot size settings in MT4. Does the fixed risk balance % work with ATR type stop loss? I am having problems with this setting. It always takes me a fixed value in the lot size.

Thank you

The strategy needs to have a stop-loss required. Only then MM lot size can be correctly calculated

in the case of risk fixes % balance, what stands for size decimals? in the case of cfd’s varies per asset? how should I calculate this decimals? thanks

The decimals value refers to a lot size used. The decimals value = 2 refer to using micro-lots that is 0.01