Documentation

Applications

Last updated on 2. 11. 2020 by Mark Fric

Fit strategy to existing portfolio

Page contents

A new functionality in StrategyQuant that allows you to find strategies that will complement your existing portfolio.

The idea behind this functionality is to find the best strategies that complement your existing portfolio and are not correlated with any of your existing strategy.

Note – this feature is available starting with StrategyQuant Build 130.

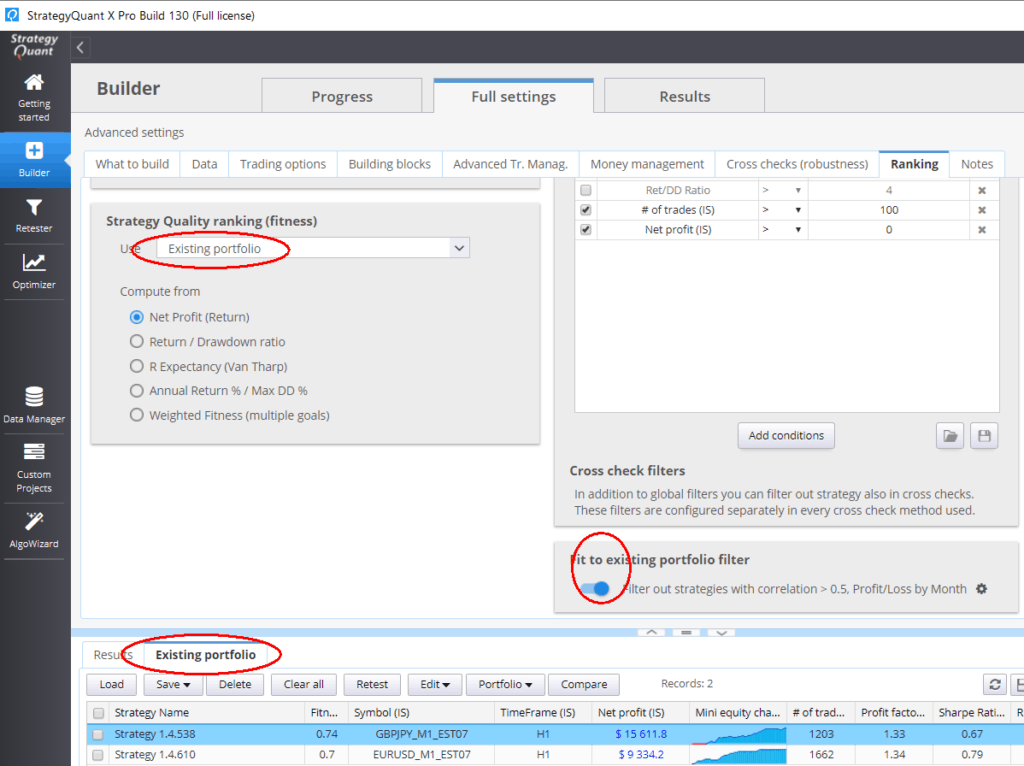

Its configuration is available in Settings -> Ranking tab in Builder and there is a new databank named Existing portfolio.

To use it, simply load a few of your aready existing strateies into Existing portfolio databank.

Then you can:

Compute fitness based on your existing portfolio

Configure fitness computation based on your existing portfolio and not the main backtest.

You can do it by selecting Use = Existing portfolio in Fitness configuration.

When configured, it will create a portfolio simulation using your new strategy plus your existing strategies and it will compute fitness of this portfolio.

By computing fitness this way you select to prefer strategies that improve the portfolio as a whole, and not the strategies that are best only on their own.

Dismiss correlated strategies

Set a filter to dismiss newly generated strategies that have too high correlation with any other strategy in your existing portfolio.

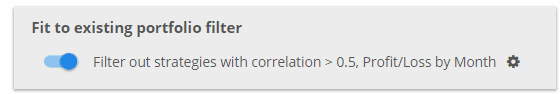

There is a new optional filter on the bottom of the Filtering conditions:

You can configure the maximum allowed correlation, what kind of correlation to compute (P/L by day, month, etc.) and a few other properties.

When the filter is active it will compute correlations between newly generated startegy and al the strategies in your Existing portfolio databank and dismisses the new strategy if any of these correlations is bigger than allowed boundary.

Was this article helpful? The article was useful The article was not useful

It would be interesting to check correlation on drawdown basis in order to keep the overall portfolio drawdown as small as possible (better if smaller than those of the single strategies).

It is a very useful function to eliminate strategies with high correlation in the portfolio. However, the premise of the current function setting is that the correlation between existing strategies in the portfolio has met the requirements, but the actual situation may be that the correlation between existing strategies in the portfolio is very high. It is suggested to add an option to the “Fit to Existing Portfolio Filter” module, which firstly removes the strategies with high correlation according to the correlation filtering criteria, so that the correlation between each two strategies within the portfolio conforms to the preset value.

Excellent idea !!!

Can we have this in a Retest Task ?